Once your battery energy storage system (BESS) reaches commercial operations in ERCOT, there is a period of time where you are only eligible to participate in the Real-Time (RT) energy market.

This is because before bidding into Ancillary Services (AS), your battery must complete ERCOT’s Checklist Part 3 (CP3) — a critical but often time-consuming approval process that confirms your asset can reliably provide reserves and regulation services.

The approval process often takes longer than operators expect.

In the meantime, RT energy-only operations offers a first — and potentially highly lucrative — path to revenue. If approached strategically, this initial phase is a prime opportunity to start earning, learn how your system performs under market conditions, and fine-tune your bidding strategy for long-term success.

In this final piece in our series on preparing for go-live in ERCOT, we’ll explore how to capitalize on the RT energy-only window—and how to lay the groundwork for AS success in parallel.

Real-Time Energy-Only Operations

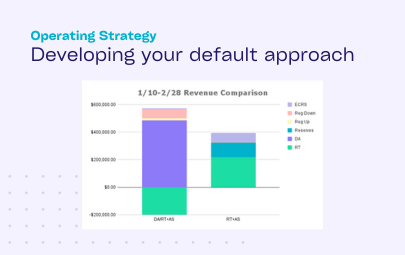

We have seen a clear shift to energy arbitrage being the primary revenue driver for BESS in ERCOT. And RT energy price spikes play no small role in that. This means that there is meaningful upside for storage operators able to begin energy-only operations as soon as their battery is energized.

This past November, one of our customers captured more than $1.50/kW during a single peak pricing event while eligible for RT energy-only. And, their total revenue for the month was higher than ~90% of operators, the vast majority of which had access to all services.

To capitalize on this phase, a nimble optimizer is essential. Many platforms are built primarily for full AS participation and struggle to pivot effectively to energy-only bidding. Our platform is designed for flexibility – and that’s proven critical in delivering strong returns, especially when CP3 approvals stretch on for months longer than expected.

Build Operational Maturity

This early phase of operations can also be a great time to deepen your understanding of market dynamics, pricing at your node, and asset behavior.

To maximize this phase:

- Put your optimizer to the test: This is the first live test of your forecasts and optimization. If you’re missing spikes or dispatching too conservatively, now’s the time to fine-tune.

- Validate your battery’s physical behavior: Observe how your battery behaves in live operations and update your optimizer with real operational data on round-trip efficiency, ramp rates, and more. Accurate modeling is key to capturing full value in RT energy.

- Hold partners accountable: Ensure telemetry, data flow, and bid submissions are fast and accurate – and all partners are adhering to agreed upon SLAs. Delays can mean missed price spikes, or worse, infeasible dispatches that put your asset at risk.

Prepare for Ancillary Services Launch

While RT energy operations is up and running and you are working your way through the Checklist Part 3 approval process, you can also be preparing for AS launch.

- Shadow bid various strategies: Continue the simulated bidding you stood up pre-launch. Understand how different approaches would perform across products and price environments. Track how your asset would have cleared, how much revenue each strategy would generate, and where risks emerge.

- Understand AS product-specific nuances – and ensure your optimizer is equipped to handle them. Each AS product comes with its own set of constraints. For example, ERCOT has a two hour sustained capability requirement for ECRS vs. a one hour requirement for RRS. Your (or your optimizer’s) ability to model and honor these rules accurately is essential for capturing upside and avoiding penalties.

- Refine your perspective on risk: With a growing understanding of dispatch behavior, you might need to think critically about your risk tolerance. Are you willing to miss some or all of a RT price spike for more consistent and reliable revenue? Might you forego more regular, comparatively high DA energy prices to be available in case RT energy spikes? By modeling these tradeoffs now, you’ll be better positioned to hone your perspective.

Finally, once you do get Checklist Part 3 approval, slowly build up to full, automated submissions. Start by submitting small bids. Once bids clear, confirm your optimizer is reading the awards properly. As the operating day unfolds, forensically examine telemetry points related to AS deployment to understand how your optimizer’s modeled SOE evolution matches up with real SOE changes during the AS hour. Said simply, does actual SOE remain within the bounds of your optimizer’s modeled range?