Market Intel

Customers

Leading energy companies across the globe trust Tyba.

Why Tyba

Unlock the full value of your energy storage assets.

-

01

Maximize revenue in a dynamic and volatile market

AI-driven price forecasts and dynamic dispatch strategies capture volatility and evolve with the market.

-

02

Automation meets control

Allow assets to run in auto-pilot mode or take control of trading decisions at any time.

-

03

Ensure compliance and manage risk

Configurable risk parameters allow you to set and evolve the risk/return profile for your assets.

-

04

Scale your portfolio

Optimize across all generation and storage assets

in your portfolio

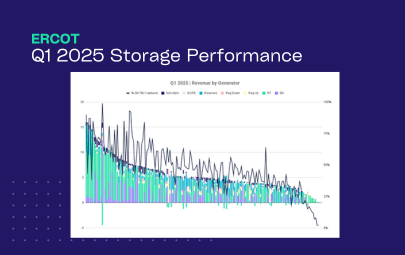

Our results

Grid decarbonization

meets profitability

-

+ 50%

Revenue uplift

Our dynamic bidding strategies yield more than double the revenue of manual bidding approaches.

-

82%

Forecast accuracy

Average Spearman correlation of 82% in ERCOT, indicating that we closely predict the shape of the price curve.

-

2GWh

Operating Assets

Across markets and project types

Use cases

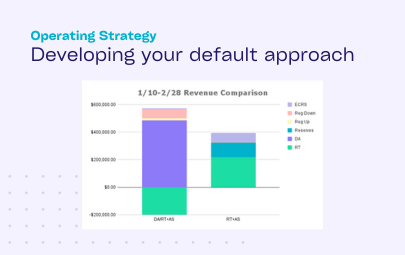

Configure, test, and deploy automated forecasting, energy optimization, and bidding strategies.

CASE STUDIES

Top performance across markets.