Intermediary between electricity generators and ERCOT; submits bids on behalf of generators and handle financial settlements.

Market Intel

ERCOT

Market Overview

The Electric Reliability Council of Texas (ERCOT) is a grid operator that manages the flow of electricity to about 90% of the state of Texas. ERCOT runs a competitive, energy-only market. Generators place bids to supply energy or reduce grid load at specific times, and ERCOT puzzles together the lowest cost way to maintain reliability and frequency.

There are a multitude of market products that generators can bid into. They all clear at different prices, in different periods, and on different days. This makes ERCOT the most complex – and also the most lucrative – market for energy storage operators.

ERCOT is the most lucrative wholesale market for storage assets today

-

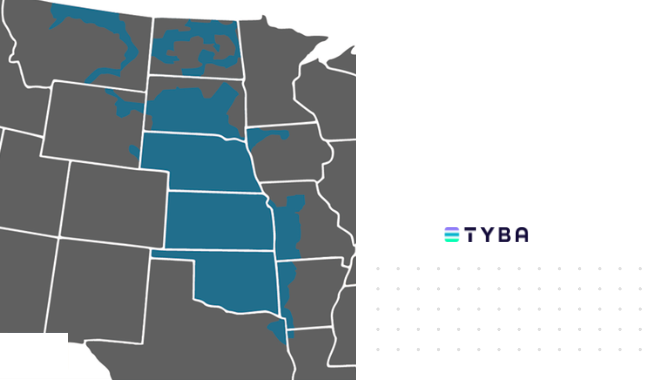

Large and growing

-

Procures all capacity from within

-

High volatility and frequent scarcity events

Overview of Market Structure

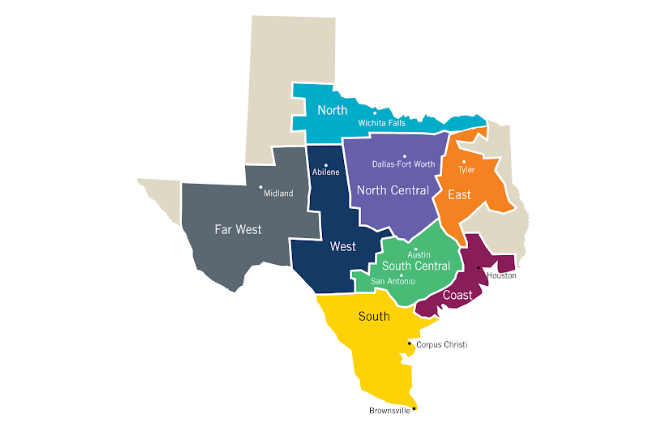

ERCOT is a competitive wholesale market that compensates generators for the electricity that they produce. The market also has a nodal pricing system, meaning energy prices differ from location to location. There are 8K+ nodes in ERCOT, and each calculates prices based on local supply, demand, and transmission constraints.

Key Players

-

Maintains reliability and manages the market to balance energy demand with supply.

-

Own and operate power generation and storage assets bid/sell to the grid.

-

-

Load Serving Entities purchase power from wholesale market to serve end customers.

-

Your market navigator; a platform leveraging real-time data and predictive insights to help maximize revenue, ensure optimal performance and grid stability.

Market products

Generators submit offers to provide energy and ancillary services. ERCOT uses these bids/offers along with grid constraints to determine market clearing prices and provide dispatch instructions.

-

Energy

Bidding into energy products can see high returns from energy arbitrage, and provides flexibility to lock in returns through the Day-Ahead Energy Market, or capture sudden price spikes in the Real-Time Energy Market.

-

Ancillary Services (AS)

This almost acts as offering insurance to the grid. You will get a payment for holding capacity, or offering to scale down generation, in moments where there is a mismatch between supply and demand. Bidding into AS can yield consistent returns, and can deliver outsized revenue during scarcity events.

Path to operations

Considerations prior to go-live

-

- Qualified Schedule Entity (QSE)

- Supervisory Control and Data Acquisition (SCADA)

-

Submit all required documentation and technical details of your assets to ERCOT to be recognized within their system.

-

- Run shadow bids as though your asset were live and review your performance. Assess how your optimizer operates, and how much revenue your strategy returns. Compare your performance to other assets in the area to benchmark results.

- Incorporate project specific offtake considerations and constraints (hedges, charge restrictions, POI constraints tied to a self limiting facility, etc.)

-

Hone in on how much risk you are comfortable taking, and adjust your approach to bidding and state of charge management accordingly.

Operating live assets

Day in the life of an operator

Case Studies

Explore ERCOT case studies

Evaluating performance

Review asset performance across operating days, hours,

and products.

Savvy operators consistently assess asset performance to ensure they are maximizing the value.

Check for:

- Show specific day: forecasts vs. actual; revenue by product

- Outline what happened, what could have been done differently

- Ensure prior commitments are met (outside contracts, etc.) and understand their impact

Growing your Portfolio

Developing your next project

Project returns vary greatly depending on node selection and asset configuration.