Case Studies

Maximizing Revenue in ERCOT’s West Load Zone

Context

The West Load Zone has the highest volatility in ERCOT

To operate successfully, it is critical for storage operators to configure unique operating plans that take daily – and even sub-hourly – conditions into account.

In H1’2024 we saw this dynamic approach yielded higher revenue outcomes than peers and specifically outperformed on a few key days.

Results

Outsized revenue capture

-

+35%

Higher returns

Than median ERCOT assets throughout H1’24.

-

60%

Higher revenue

Compared to peer assets on a particularly high revenue day.

Our approach

Baseline, Tyba’s optimizer balances Ancillary Services (AS) with energy arbitrage to deliver consistent revenue without Failure to Provide risk. We help operators outperform during H1’24 by:

- Recommending dispatch strategies that accounted for unique market conditions

- Continuous re-forecasting and automated state of charge management to enable intra-hour optimization

- Not shying away from Day-Ahead Energy bids when the forecasts predict high prices

Our strategy yielded market-leading returns

We compared the revenue profile and outcomes of Tyba’s default low-risk operating strategy to those of ERCOT assets with the following 2023 revenue performance:

- Top performer: highest 2023 revenue

- Median performer: consistently performed in the middle

- Top quartile: revenue in the top 25%

Operating Day Deep Dive

May 26, 2024

Tyba’s AI-powered forecasts ingest data to forecast highly accurate prices for all available market products.

- Location-level: Temperature, irradiance, wind, dew, LMPs, etc.

- Grid-level: Supply, demand, outages, constraints, etc.

On May 26, forecast accuracy enabled us to net 60%+ higher revenue than peer assets in the West Load Zone.

Every day in ERCOT is different.

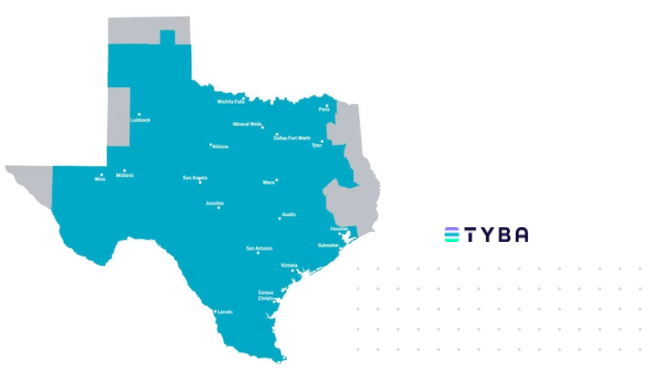

Tyba’s platform helps leading BESS operators develop and execute winning operating strategies.