Market Intel

Guides

Operating a storage asset in CAISO may look straightforward at first glance — prices follow the duck curve, so just buy low and sell high, right? In reality, revenue-maximizing operations are far more nuanced. Market rules, project-specific constraints, and Ancillary Services (AS) requirements all layer complexity onto both day-ahead planning and real-time management.

A well planned, thoroughly tested operating strategy is key for energy storage operators that hope to maximize returns.

To consistently capture value, operators need to account for more than just the daily shape of prices. A few key considerations:

On September 2nd, CAISO’s NP15 experienced a rare Real-Time (RT) energy price spike with prices clearing over $400/MWh starting at 7pm – just as the solar ramp down was wrapping up.

To maximize performance on this high revenue opportunity day, preparation began in the day-ahead.

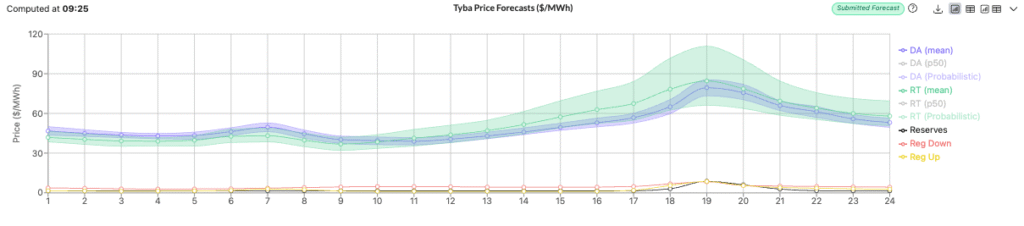

Our price forecasts pointed to elevated RT energy prices during the evening ramp down. To position the asset to capture the high prices, we limited IFM awards by submitting bids/offers only at price levels that would make the tradeoff worthwhile — above the P90 of our RT price forecasts — or not clear. This way, we reserved capacity for RT without reneging on must-offer obligations mandated via RA.

On the morning of September 2nd, the asset charged at the lowest prices of the day thanks to our Price Quantity (PQ) bidding structure, which allowed us to have opportunistic bids in. By the time the evening ramp down arrived, the battery was at a nearly full state of charge. Offers were submitted ahead of the 75-minute lockout, and PQ bidding ensured that additional capacity was dispatched incrementally as prices climbed. The strategy ultimately delivered $0.72/kW in revenue for the day.