Market Intel

Guides

Operating in CAISO isn’t as simple as “bid once and wait to see if you clear.” The market works in layers – and while the ISO aims to procure all required capacity in the Day-Ahead, they have two additional, balancing market runs for each interval throughout the operating day.

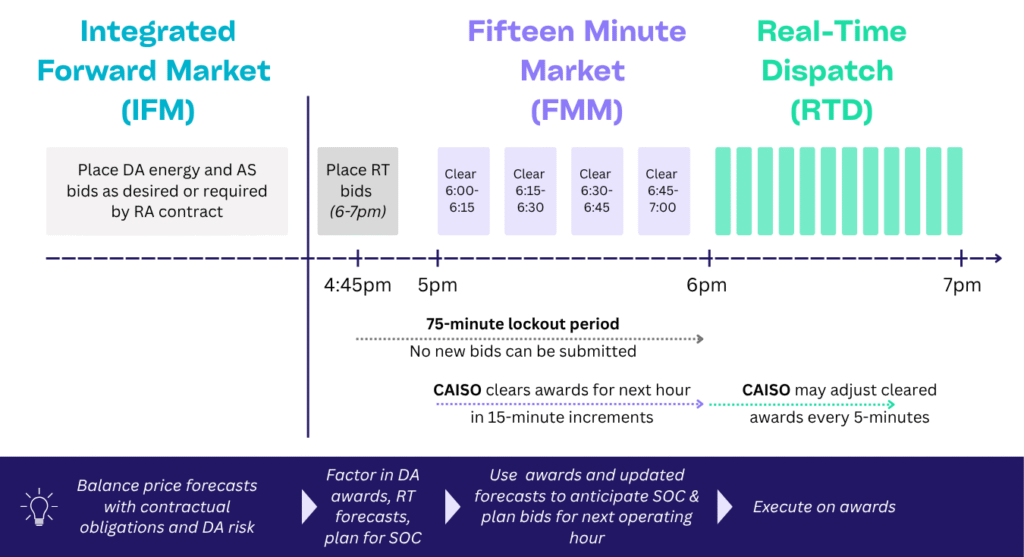

Not to mention, the timing for bid submissions and cleared awards varies across all three. And bids are due well in advance of the operating interval.

For energy storage operators, this creates a unique challenge. You need to plan for multiple scenarios, bid with incomplete information, and adjust positions continuously.

All bidding begins in the IFM. The morning before the operating day begins, operators submit bids for Day-Ahead (DA) energy and/or Ancillary Service (AS) products for each operating hour desired. Often, though, batteries with Resource Adequacy (RA) contracts are required to bid into every hour. CAISO’s goal is to secure 100% of demand in the IFM, but adjustments can still happen later in real time.

When bidding into the IFM – or deciding the price points to bid at – operators need to calculate the tradeoffs. On the one hand, you lock in rates and can more easily plan your operating day. On the other, DA awards come with deliverability risk. If you don’t have the state of charge (SOC) to deliver on a DA AS obligation – whether it is from an unexpected outage or a recent discharge – CAISO can award a charge action you didn’t want, which might mean charging at an uneconomic price.

Furthermore, as is always a risk, DA commitments can inhibit a battery’s ability to capture higher real-time prices.

Once the operating day begins, CAISO’s FMM begins. Operators must submit bids 75-minutes prior to each operating hour – this is often referred to as the 75-minute lockout period. CAISO then clears these bids in 15-minute blocks leading up to the operating hour.

EXAMPLE: For the 5-6pm hour:

While CAISO clears bids/offers in advance, operators only get that information in the moments before the operating interval via the Automated Dispatch Signal (ADS). This creates obvious complexity for storage operators since you need to place bids with incomplete information. Not only will your price forecasts be missing data for the 75+ minutes between when you submit your bids and when the dispatch takes place – but you also won’t know if your previous bids cleared. This creates constant SOC uncertainty.

Tyba’s Asset Operations platform was built to handle this complexity. Our real-time price forecasts intake grid conditions and historic trends to improve accuracy – even 75-minutes out. Our optimizer uses that input, plus any DA obligations to formulate a bid plan for the upcoming interval. It generates Price-Quanity (PQ) bids so we bid/offer specific quantities only for price levels at which they are economically advantageous. This way, we are able to capture unexpected spikes, and avoid dips.

Finally, the platform looks at all possible clearing scenarios before bid submission to ensure we will have adequate SOC or headroom to deliver on bids/offers. This is critical for feasibility, deliverability, and penalty avoidance.

In the operating hour, CAISO moves into 5-minute dispatch intervals known as the RTD. Here, CAISO balances sudden changes in system conditions, such as an outage, a drop in renewable generation, or a spike in load. Your FMM award may be adjusted up or down, and additional MWs can be dispatched in real time.

This RTD can cause uncertainty for the next operating hour. Think about it. You have already submitted bids – since they were due 75 minutes in advance – but now you could clear more or less than expected based on the FMM.

It is important to be able to estimate how much capacity will get dispatched in the RTD so you can predict your SOC. Knowing the SOC you will end the operating hour with allows you to be more aggressive in your FMM bidding – which ultimately leads to higher revenue.

Let’s say you operate a 20MW, 4-hour battery and are bidding into the 6–7pm hour – a common peak in CAISO due to solar ramping down for the day.