Current State

U.S. Energy Markets

There are seven primary power markets in the United States today. They all have different pricing dynamics, regulations, and are evolving at different rates. One commonality that exists – they are all growing. With peak electricity demand expected to increase by over 100GW by the end of the decade, batteries will be essential to ensuring we can reliably power people and businesses. However, operating storage assets effectively can be challenging given the complex and varied markets.

That’s why we’re committed to demystifying these markets and equipping battery operators with the insights they need to perform efficiently and effectively — helping build a cleaner, more reliable energy future for everyone.

-

CAISO

-

NYISO

-

PJM

-

MISO

-

ERCOT

-

ISO-NE

-

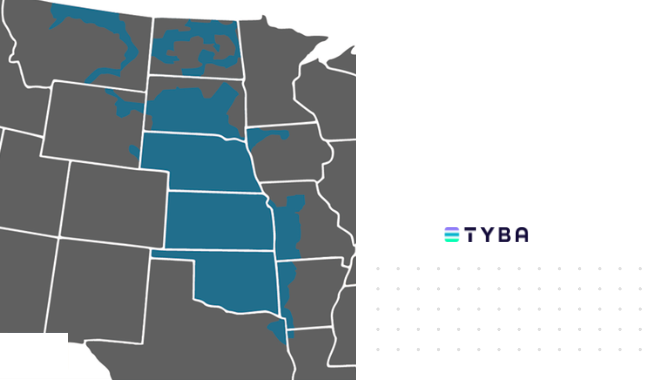

SPP

Snapshot:

-

01

CAISO

Momentum

strong

Bess Capacity

~11GW

Storage Targets

52GW Storage Demand

-

02

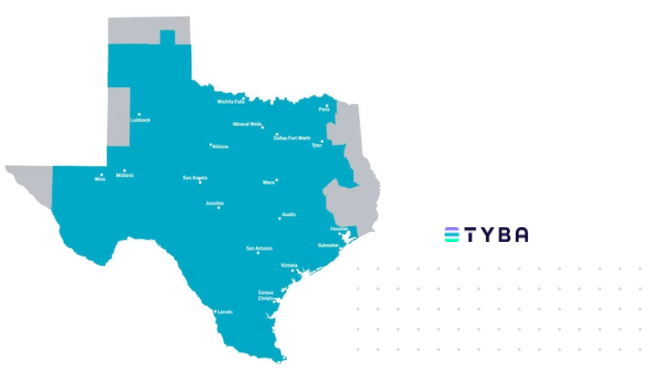

ERCOT

Momentum

strong

Bess Capacity

~6.5GW

Storage Targets

N/A

-

03

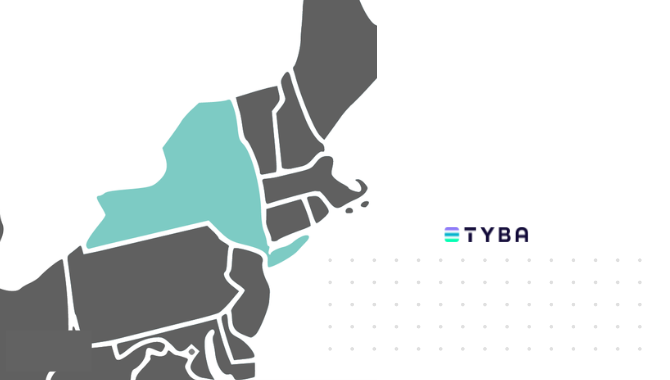

NYISO

Momentum

medium

Bess Capacity

~0.2GW

Storage Targets

6GW Storage by 2030

-

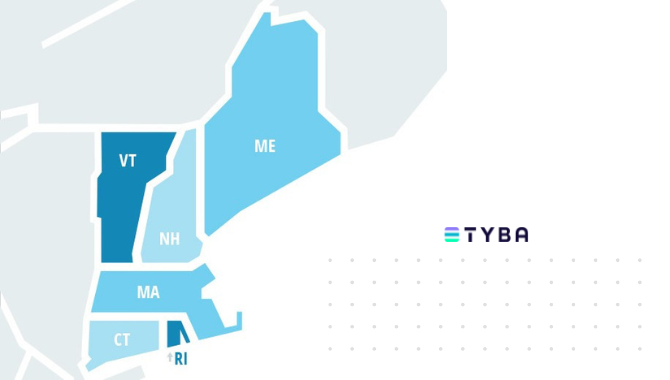

04

ISO-NE

Momentum

medium

Bess Capacity

~0.4GW

Storage Targets

3GW Storage Across 4 States

-

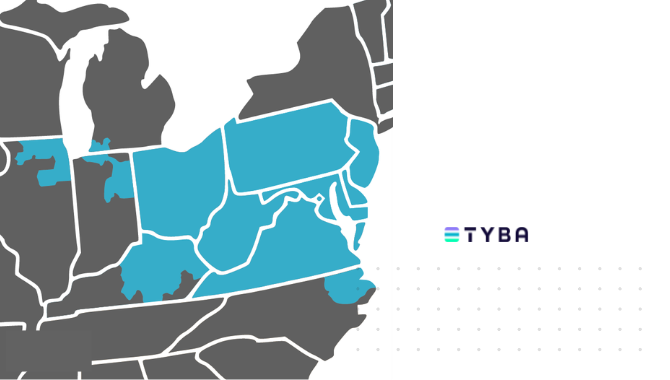

05

PJM

Momentum

low

Bess Capacity

~0.4GW

Storage Targets

~18GW Across 5 States

-

06

SPP

Momentum

low

Bess Capacity

<0.1GW

Storage Targets

N/A

-

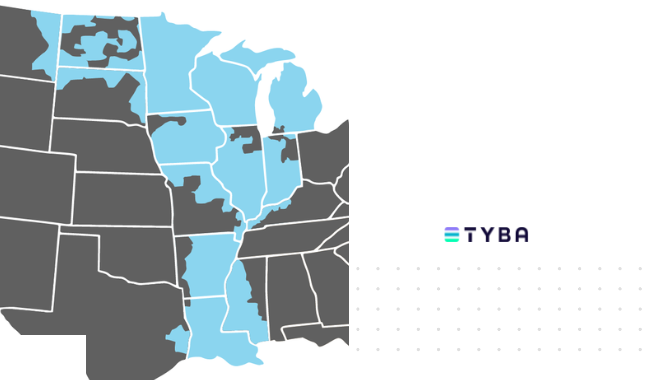

07

MISO

Momentum

low

Bess Capacity

<0.1GW

Storage Targets

10GW Across 2 States

-

Market Intel

Learn moreERCOT: Fast growing, energy-only market servicing 24M+ Texans.

-

Market Intel

Learn moreCAISO: Market-leading ISO supporting 32M+ in California

-

Market Intel

Learn moreNYISO: Up and coming market serving ~20M New Yorkers.

-

Market Intel

Learn moreISO-NE: Emerging market for storage, covering 15M across six states.

-

Market Intel

Learn morePJM: The largest RTO by load and population, serving 65M+ across 13 US states and DC

-

Market Intel

Learn moreSPP: An energy market serving 14 U.S. states and ~18M people.

-

Market Intel

Learn moreMISO: Large energy storage market spanning 15 U.S. states and Manitoba.