Guides

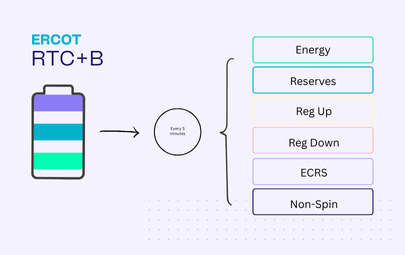

Guide to ERCOT RTC+B

Guides

Why They’ll Add Real Complexity to ERCOT Storage Operations

One of the quieter, but more operationally important, changes coming with RTC+B is how ERCOT applies duration requirements for real-time Ancillary Services. On paper, this looks like a simple rule tweak. In reality, it injects a new layer of state of charge (SOC) constraints into every bidding and dispatch decision you make.

Below is a breakdown of what’s changing, and why it meaningfully complicates operations for storage.

With RTC+B, Ancillary Service (AS) duration requirements are changing. And, for all Real-Time (RT) AS bids/offers, duration requirements will be rolling and forward looking. This means that when a RT AS offer is placed, operators will need enough SOC for the length of the requirement, even though the offer is only for the next 5-minute interval.

This is enforced by telemetered SOC, so any offers that do not strictly follow the rules are subject to mitigation in SCED.

For RT operations, this may not seem particularly complex at first glance. You just submit offers for the capacity you have available. However, when you account for the fact that, in order to cover a Day-Ahead (DA) AS award, you need to place a RT AS bid for each interval in which you have the award – things get a bit murkier.

Let’s say you discharge energy (or your AS award gets called) such that your SOC dips below the requirement for your awarded AS capacity. This would prevent you from offering sufficient capacity in the next interval to deliver on your DA award, and you would incur imbalance charges.

Every operating decision you make needs to be informed by your DA awards and forward-looking strategy – and you need to constantly calculate whether the earnings from any given dispatch will yield your desired revenue, accounting for any imbalance it may lead to and how it inhibits you from future bids/offers.

At a high level, this raises the value of SOC – and the opportunity cost of dispatch. Let’s walk through a few examples of how this change adds complexity.

If you have a DA AS award, or combination of awards, that would require your full SOC to cover in RT operations, any deployment or voluntary dispatch will lead to an imbalance charge in the next interval – and any subsequent intervals until you recharge or the relevant operating hour runs out.

Example:

Assume you have a 100MW x 2 hour battery and at 6pm you have DAM awards for:

To cover the 50MW DA Non-Spin position, you would need to have a full SOC and offer it entirely into RT Non-Spin in each interval of that hour. If you’re deployed — or if you discharge even modestly into RT energy — your SOC falls below what’s needed to offer the 50MW capacity in the next interval. That triggers an imbalance charge. And you’ll continue to incur imbalance every interval until you are able to recharge or the hour is up. This dynamic directly limits how aggressive you can be in RTM operations. A single interval of discharge can turn into multiple intervals of imbalance exposure, or you may end up forced to recharge at a price that’s higher than you’d like to avoid the imbalance exposure.

Even if your DA AS awards do not require your full SOC to cover the position, they may still impact how aggressively you pursue RT energy or AS. Any dispatch that pulls your SOC below the duration requirement for that award will create imbalance exposure in the next interval — and that exposure persists until you recharge or until the award window ends.

Example:

Assume you have a 100MW x 2-hour battery and at 6pm you’re holding:

In order to cover the 50MW DA ECRS position, you need to reserve at least 50MWh of energy as well as clear 50MW of ECRS every 5-minute interval of the hour to avoid imbalance charges. In a scenario where RT energy prices spike, you can only discharge until you hit a 50MWh SOC before dipping below the duration requirement. If you discharge more than that your SOC will be insufficient to offer the full 50MWs of RT ECRS in the next interval. That triggers an imbalance charge. And as with the first example, you’ll continue to incur imbalance every interval until you recharge or the hour rolls off.

For every interval, operators have to decide whether it is advantageous to pay the imbalance to capture the RT energy price. It’s no longer “does this RT energy price look good?” but “does it look good enough to justify triggering imbalance and paying to recharge later?”

Even before the DA award window begins, these new duration requirements will force operators to calculate the tradeoffs. If you have an upcoming hour with a DA AS position, aggressive RT activity in the preceding intervals – or even hours – can leave you undercharged when the operating hour starts. That SOC shortfall will immediately translate into imbalance exposure.

Example:

Assume RT energy prices spike at 7:45pm, and you discharge 75MW to capture the opportunity. But you have a 50MW DA Non-Spin AS obligation beginning at 8pm.

Unless you recharge quickly — and at whatever price the market gives you — you won’t have sufficient SOC to cover the 50MW DA Non-Spin position in the first interval of the award hour. Any discharge decision in the hour leading up to an AS obligation needs to factor in both the time available to recharge and the cost of that recharge — otherwise you risk entering the obligation window in an imbalanced position before you’ve even begun.

Even if you’re not holding any DA awards, dispatching any energy reduces your SOC and will naturally limit future RT AS and energy offers.

Example:

Assume you have a 100MW x 2-hour battery, are at 25% SOC (50MWh), and at 6:05pm you want to offer the following:

If you clear either RT AS position and are dispatched, you’ll need to ratchet down your next-interval offers across both products – and you stay constrained until you recharge. For example, if you are down to 40MWh of stored energy by 6:30pm, your bids will be limited to 40MW in ECRS and 10MW in Non-Spin.

This raises the bar for real-time optimization.

RTC+B makes SOC and imbalance risk central to every dispatch decision. Our approach explicitly accounts for the way being dispatched — or voluntarily discharging into energy — affects both future AS bidding and potential RT imbalance exposure.

AS awards provide consistent revenue, but may limit your potential to capture higher-priced energy opportunities. Tyba’s optimizer continuously calculates the revenue-maximizing tradeoff between these competing pressures.

To operationalize these tradeoffs, it is important for storage operators to have a system that allows you to tailor to your approach to your company’s evolved risk policy:

By embedding SOC value and imbalance risk directly into bidding and dispatch logic, Tyba helps operators capture the most value from every interval while avoiding unnecessary penalties — a critical advantage as RTC+B adds complexity to ERCOT operations.

Post RTC+B, AS imbalance will work in a similar way as the current DA vs. RT energy imbalance settlement.

Example: You clear 100MW of ECRS in DA at $10. For that same hour, you do not cover any of the DA ECRS position through RT operations, and RT ECRS prices average out to $20 that hour. You would be exposed to a $1,000 imbalance charge [100MW x ($20 RT less $10 DA)].