Guides

Guide to ERCOT RTC+B

Guides

Capturing a real-time energy price spike in the first week of RTC+B.

With the ability to offer into both Ancillary Services (AS) and energy in real-time, the rollout of RTC+B has introduced a new level of optionality — and complexity — for storage operators.

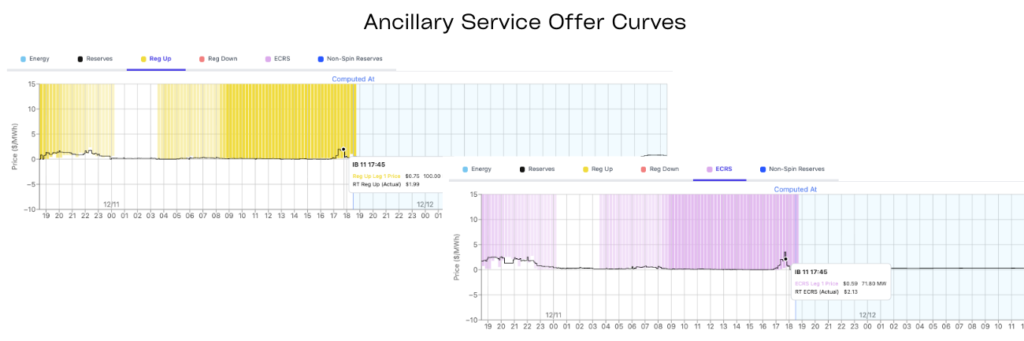

It can be lucrative to offer into RT AS products in most intervals so that you earn incremental revenue through capacity payments, and provide reliability in the form of backup power to the grid. However, because ERCOT chooses which product to clear you into when you have multiple clearable offers submitted, this strategy only works if you are crafting your offers strategically.

If those offers aren’t carefully calculated, you risk clearing a low priced AS offer and missing out on a RT energy price spike that could have made you hundreds, or even thousands of dollars per megawatt hour.

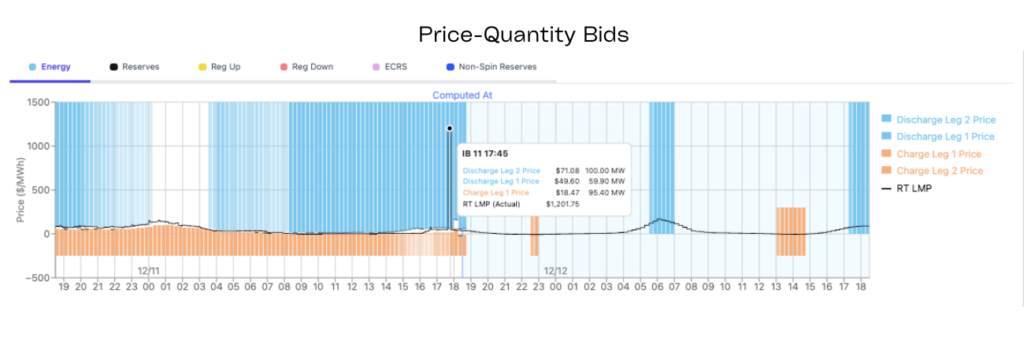

Below, we walk through a real example from week one of RTC+B, where Tyba’s optimizer captured a localized price spike without sacrificing AS revenue earlier in the day — illustrating how strategic bidding can unlock upside without exposing operators to unnecessary opportunity cost.

Throughout the day, we placed a myriad of RT AS bids and offers to pick up incremental revenue throughout the day when the battery would have otherwise been sitting idle. We also spread our offers across products to optimize the mix, and maximize revenue capture while adhering to all duration requirements.

Here is the trick. We also had energy offers in for each of these intervals – and we priced them at a level such that should there be a pricing event, we would clear into RT energy and capture the premium. This is precisely what happened at IB17:45. There was a localized, congestion driven price spike that caused RT energy prices to shoot up to ~$1,200.

In that interval, we had RT AS offers in that would have been clearable – but the marginal cost to replace them to ERCOT was minimal, costing only a few cents to a few dollars.

At the other end of the spectrum, the marginal cost to replace our energy offer would have been much higher. For this reason, we were cleared into RT energy and able to capture the price peak.

This is exactly the type of moment where operators who are not bidding methodically will lose money. A poorly structured AS bid would have locked the asset into a low-value award right as the market peaked.

This example is just one interval – but it reflects a broader truth. In RTC+B, execution matters more than ever. The operators able to take advantage of these new opportunities and that are able to solve the interval-by-interval optimization puzzle in real-time, will consistently outperform.