ERCOT Storage Performance

ERCOT RTC+B Week 1

Looking back at storage asset bidding strategies and storage operations during the first week of RTC+B.

Heading into the first week of ERCOT’s Real-Time Co-optimization + Batteries (RTC+B), uncertainty was the dominant sentiment among storage operators.

That uncertainty led the majority to stay out of the Day-Ahead Market (DAM) – particularly in the first few days – given the risk associated with carrying DA awards in this untested market construct. In retrospect, that hesitancy came at the expense of revenue opportunity.

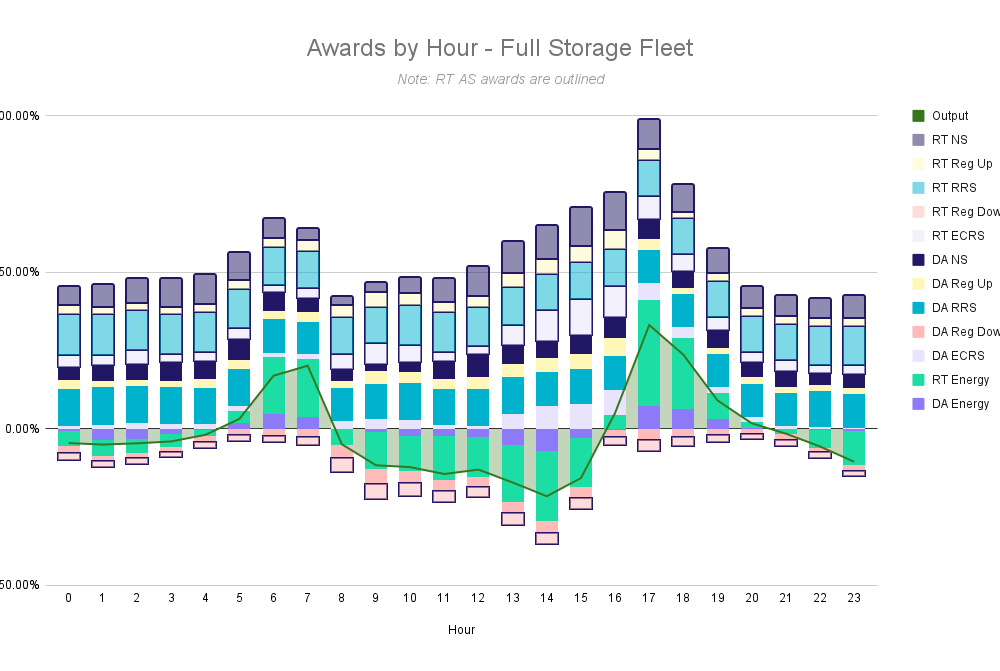

Fleet revenue was concentrated in Real-Time energy – despite DA AS premiums

This is all too clear when looking at the revenue composition of ERCOT’s storage fleet in those first few days of operations under RTC+B (12/6-11).

- 56% of total fleet revenue came from Real-Time (RT) products

- Of that RT revenue, 95% came from RT energy

- Large portions of the RT energy revenue were from two days (12/6 and 12/10) where there were relatively high (up to $80/MWh) price prints

When it comes to Ancillary Service (AS) products, roughly 50% more of the fleet’s capacity carried awards in RT AS than in DA AS, but an overwhelming 94% of AS revenue came from Day-Ahead AS awards.

Why? Because DA AS prices consistently cleared at meaningful premiums to RT AS. In other words, operators largely avoided the market that ultimately offered the strongest pricing.

Pricing across markets and products

As mentioned above, revenue was not indicative of where the highest prices were from 12/6-12/11. Looking specifically at energy markets, RT did have a slight premium to DA – especially in the evening peak hours.

Ancillary Services told the opposite story. For most AS products, Day-Ahead pricing materially exceeded Real-Time pricing throughout the week. This was especially pronounced in:

- Non-Spin: on average, DA Non-Spin cleared 35% higher than RT

- Reg Up: DA Reg Up was ~4x higher than RT on average

While the biggest spreads did occur during or surrounding peak intervals, positive DART spreads were available across much of the day. That created relatively low-risk opportunities for operators comfortable managing award obligations and duration constraints.

Bidding approaches

Participation patterns during RTC+B week one reflected the uncertainty operators felt heading into the new construct.

Across the full fleet, many largely avoided the Day-Ahead Market (DAM) altogether, viewing it as higher risk given uncertainty around how RT prices would clear, and the impact of co-optimization and the new AS duration requirements.

- On average, just 2.5% of total fleet capacity was awarded in DA energy compared to 10.9% in RT energy

- During peak hours (HB 6-7 and 17-18), average DA energy awards rose modestly to ~5.5% of fleet capacity, but RT energy participation jumped to ~23.5%

In Ancillary Services, participation was similarly restrained in DA. Roughly 5% of fleet capacity was awarded in DA AS, with the largest portion of that in RRS, which accounted for ~45% of DA AS awards.

Taken together, fleet-wide bidding behavior leaned heavily toward flexibility and optionality — even when DA pricing suggested a stronger forward opportunity.

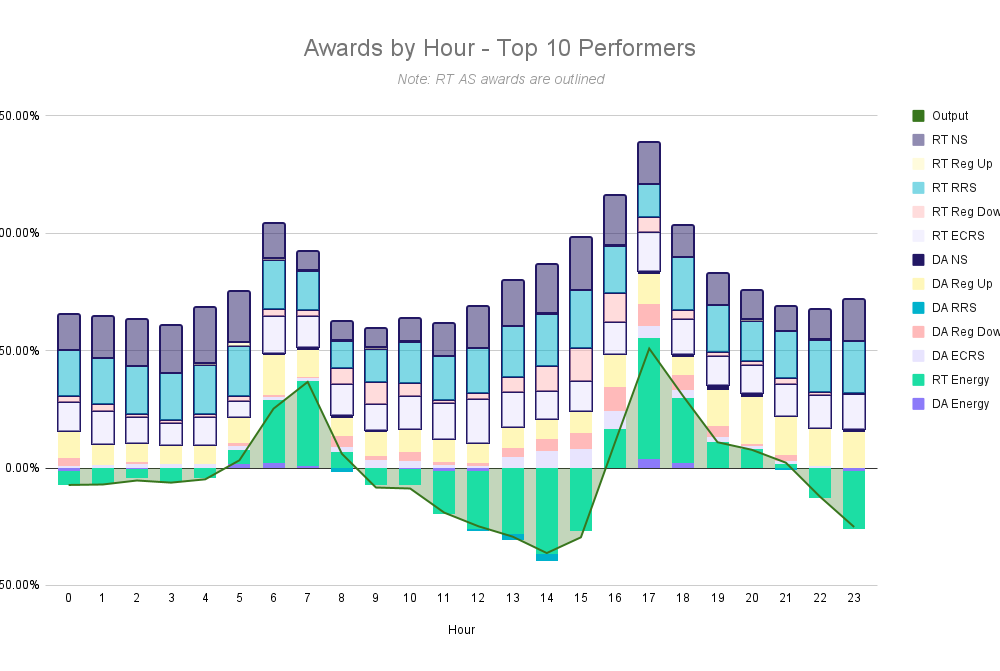

If we filter down to the top 10 performers (measured by % of DA TB2 captured), we see significantly more activity overall, with an average output ~17% vs 11%. Much of this incremental participation was in RT energy (16.8% for top performers vs. 11% for the full fleet), which signifies more willingness to cycle / discharge even if prices weren’t sky high.

This was also complemented by a willingness to bid into DA Non-Spin (avg. 13% vs 5% of capacity awarded), which saw premium pricing throughout the week.

Essentially, these high performers were more willing to take calculated risks – and it paid off in this environment.

High performing operating strategy

Zooming in on one top-performing asset, which captured 103% of its DA TB2 opportunity and ranked among the top 10 revenue generators, we can see how its operating strategy evolved over the week as pricing signals became clear.

12/6

At the start of the week, this asset mirrored much of the broader fleet’s posture with participation in the DAM. The battery did a bit of RT energy dispatch in the morning and evening peaks, and even successfully captured the highest price of the day (~$120/MWh at 7am).

12/8

As the week progressed, this asset recognized the DA AS premium and adjusted their approach accordingly. Just a couple days into RTC+B and we can see aggressive DA AS offers, largely focused on the products that have been showing the highest spreads – RRS, Reg Up, and Non-Spin.

Notably, the asset did not cover these awards in RT and instead pocketed the DART spreads that ran as high as ~$18/MWh in reserve products. Now, this strategy does not come without risk as DA AS awards come with exposure to adverse DART spreads if RT prices exceed DA clears.

Without careful SOC management and strong price forecasting, this strategy can backfire quickly.

But in this pricing environment — where DA premiums were persistent and RT AS lagged — it paid off.

12/10

By the end of the week, the asset expanded its forward posture even further – offering a significant portion of capacity into DA energy across most hours of the day, and layering on some RRS and Non-Spin.

This is one of the riskier strategies available. It effectively banks on positive DART spreads materializing and requires high confidence in price direction. If RT had cleared materially above DA, the exposure could have been painful.

But during a week when DA pricing carried consistent premiums across both energy and AS, the strategy worked.

Broadly speaking, outperforming in ERCOT increasingly requires a willingness to take on calculated DA risk. Avoiding it entirely may protect against downside — but it also caps upside. To do this well, though, requires the right tools that can help foresee opportunities, manage against awards in RT, and help capture available upside without major misses.

*Top earners defined as highest $/kW **Top performers defined as highest percent of DA TB2 captured