Case Studies

ERCOT Storage Performance | Q3 2025

Looking back at storage asset operations and performance outcomes from Q3 2025 – and breaking down quarter-over-quarter trends.

Q3 delivered a more challenging revenue environment for battery storage operators in ERCOT. Compared to Q2, both revenue and performance were down – telling us that revenue opportunity was lower, yes, but much of the fleet also did not capture it as well as they could have.

In keeping with the year-long trend across ERCOT, energy accounted for an increasing portion of the revenue stack – and operators that leaned in on energy arbitrage saw the best outcomes.

Revenue outcomes

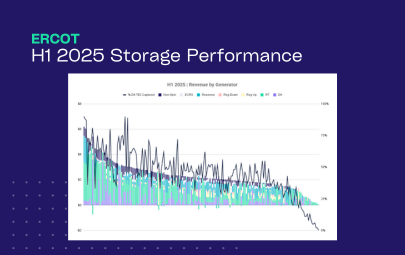

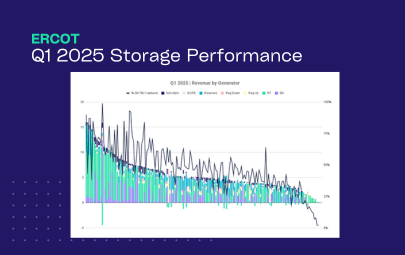

Average fleet revenue was down ~35% compared to Q2, reflecting the softer market conditions and weaker overall performance. Even the top 20 earning assets made, on average, $1.33/kW month less quarter-over-quarter.

- Highest earning asset made $7.72/kW-month, while the top 50 revenue generators averaged $3.16/kW

- The median asset brought in $1.68/kW-month, with the fleet average slightly higher at $1.80/kW

- Energy arbitrage was the name of the game, with DA and RT energy comprising 73% of fleet revenue

From July through September, energy made up the vast majority (73%) of fleet revenue, with DA and RT energy accounting for almost equal portions (36% and 37% respectively).

The top revenue generators leaned even harder into energy, making 88% of their revenue in these products, and deprioritizing AS almost completely. Interestingly, the top-performing assets (by DA TB2 capture) skewed more heavily toward DA energy, which accounted for 56% of their quarterly revenue — a signal that disciplined forward positioning paid off in this environment.

Asset performance

As in prior quarters, performance outcomes varied widely across the fleet. For the most part, we see the top performing assets leaned on DA energy. In this lower volatility environment ( average RT TB2 down over 20% QoQ), operators had to be more proactive and strategic with their DAM bidding to maximize revenue capture.

- Top performing asset captured 132% of its DA TB2 opportunity, and the top 50 averaged 76%

- Median asset captured 46%, with the fleet average coming in similarly at 47%

These benchmarks help normalize for nodal price volatility and shift focus to the operational question that truly matters: how effectively did your asset convert available opportunity into realized revenue?

Quarter-over-quarter results

Quarter-over-quarter, energy arbitrage continues to grow as the dominant revenue driver. Though, this trend may be challenged under RTC+B, which is officially live and showing some interesting AS DART spreads in the first few days.

As was mentioned above, performance was also down compared to Q2 2025, though this underperformance cannot be attributed to market conditions alone. While overall revenue opportunity declined, fleet-wide execution also weakened. In other words, operators captured a smaller share of the opportunity that did exist.

With Q3 showing weaker performance alongside softer markets, it’s clear that strong operations are now table stakes for top-tier performance.

As RTC+B reshapes real-time market behavior, the stakes rise even further. Real-time co-optimization demands increasingly proactive, nimble, and strategic operations. Operators that struggled to meet expectations before are likely to feel those gaps more acutely in this new market landscape — and should be scrutinizing whether their tools, processes, and partners are truly equipped for what’s ahead.

Top operator strategies

Looking across Q3’s top operators, we examined how their strategies evolved quarter-over-quarter. The result: a wide range of approaches can succeed—but only when they align with nodal realities.

- The top performer, consistent throughout the year, has always leaned into energy arbitrage. As they climbed the rankings quarter-over-quarter, they grew increasingly aggressive in Day-Ahead energy — and were even willing to take Real-Time losses in support of that strategy.

- The #2 performer in Q3 is more of a Cinderella story. After starting near the bottom of the pack in Q1, they broke into the top third in Q2 with an Ancillary Services–heavy approach. In Q3, they pivoted toward more aggressive energy arbitrage, a shift that carried them onto the leaderboard. A clear example of strategy refinement paying off.

- The #4 performer maintained a more balanced approach throughout the year. Energy still led their revenue mix, but they continued to generate meaningful Ancillary Services revenue, avoiding over-concentration in any single product.

Three top performers. Three distinct operating strategies. This variability speaks to just how node-specific ERCOT really is — and why no single playbook guarantees success.

Now more than ever, as RTC+B is changing the market dynamics it is important to hone in on the operating strategy that will be best for your asset – and be able to adjust as new data comes in and what works best evolves.