Guides

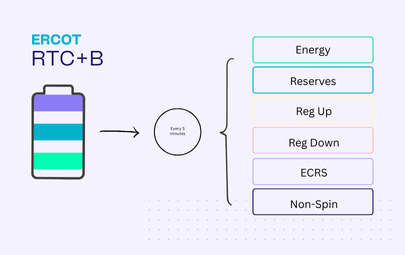

Guide to ERCOT RTC+B

Case Studies

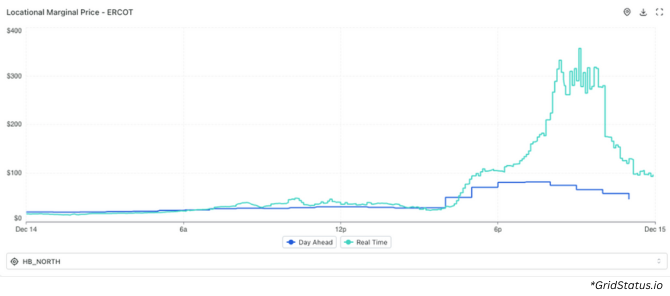

On December 14th, a late evening price spike across most of ERCOT – the first widespread spike post-RTC+B implementation – offered a sharp reminder of how unpredictable the ERCOT market can be, and how execution decisions earlier in the day can determine whether storage assets are able to capture unexpected volatility.

What happened?

Between 8:00–10:00pm real-time energy prices spiked across most of ERCOT, peaking ~$400/MWh around 9pm. The exception was the Houston Load Zone, where congestion ultimately muted the price response. Elsewhere, conditions aligned to produce a meaningful pricing event.

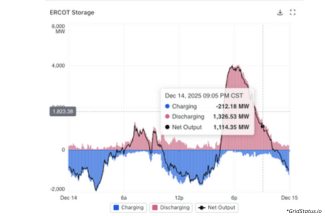

For storage operators, the evening highlighted an important challenge – being available when the market actually peaks, not just when it usually does.

Capturing the late price spike required a few key steps:

The price formation anomaly continued overnight, where RT energy prices rarely dropped below $100/MWh, and into the next morning. Around 7:25am we saw another energy peak (~$250/MWh) and elevated RT AS prices, with Reg Up, ECRS and Non-Spin all clearing between $40-45 – well above their DA clearing levels of $9-16.

Since no one has a crystal ball, this dynamic makes the optimization problem a challenge.

In order to catch the RT spike and/or not run into imbalance with any DA AS obligations you may have had, operators would have needed to charge overnight. To do so at these high prices would necessitate a belief:

Tyba’s optimizer did exactly this. Forecasting the high prices we ensured our DA AS offers were high enough that they did not clear (the flipside of which is, had they cleared, it would have been lucrative), charged up overnight, then discharged at full blast into the morning RT energy peak.