In December 2022, New York State Department of Public Service (DPS) and New York Energy Research and Development Authority (NYSERDA) announced a new framework to achieve 6GW of energy storage in the NYISO market by 2030. This roadmap proposes the implementation of NYSERDA-led programs to procure 4.7GW of new storage broken out across:

- 3GW of bulk storage procured through an Index Storage Credit (ISC) Mechanism.

- 1.5 GW of retail (Community/C&I) storage and 200 MW of residential energy storage procured through the existing VDER structure.

The proposal is currently going through a public commenting period and would potentially be approved by the state before the end of this year.

Why the Index Storage Credit (ISC) approach and how does it work?

DPS and NYSERDA considered a range of alternatives including upfront rebates, clean peak credits (similar to Massachusetts), and utility owned and/or operated options. The ISC approach scored highest across the range of evaluation criteria used by DPS and NYSERDA, including implementation feasibility, developer friendliness, and value to ratepayers.

The ISC approach is modeled after New York’s Index REC structure. To make that more applicable for energy storage, each ISC represents one MWh of energy capacity that is operational on a given day. This means that each day a storage project is operational, it would be credited with and compensated for a number of ISCs equal to the MWh of storage discharge capacity of the unit, regardless of how frequently the battery actually cycles.

Payment per ISC is calculated as the Strike Price less the Reference Price. The Strike Price is the price the developer bids into the program and in theory represents the revenue level needed to make the project pencil.

- The Reference Price is the sum of the Reference Energy Arbitrage Price (REAP) and Reference Capacity Price (RCP).

- The REAP is based on a TxBX methodology using the zonal Day-Ahead (DA) LBMP.

- As an example, for a 4 hour battery based in Zone J, the daily REAP would be calculated as the average of the top 4 highest price hours less the bottom 4 lowest price hours that day of the Zone J DA LBMP.

- The RCP will be based on the ICAP spot auction with location-specific pricing given capacity prices vary across zones in NYISO.

The ISC calculation will be determined monthly based on realized prices for the previous month. In addition to the ISC Strike price, a developer would also include a maximum ISC price, which sets a cap on maximum ISC value for any given month.

Example Calculation:

- Strike Price = $100/MWh

- Top 4 Hours Average = $80/MWh

- Bottom 4 Hours Average = $30/MWh

- REAP = $50/MWh

- RCP = $30/MWh

- ISC Value = $20/MWh

Opportunities & Risks for Storage Developers & Operators

The proposed program represents a major opportunity for storage developers & operators, as it provides greater revenue certainty for project investors. In addition, it leaves significant upside to merchant operators who can maximize locational and operational strategies.

Upside

- Real Time (RT) Energy – Operators who can effectively bid into real time energy markets may be able to achieve energy-related revenues beyond the REAP benchmark.

- Ancillary Services – Operators who can effectively bid into NYISO’s ancillary services market may be able to achieve upside beyond the REAP + RCP value.

- Node vs. Zonal LBMPs – Nodes that have persistently higher/more volatile DA energy prices than the Zonal reference could earn energy arbitrage revenue greater than the REAP benchmark.

Risks

- REAP Benchmark – The reference benchmark does not factor in price uncertainty (i.e you may not dispatch into the best and worst hours of pricing), nor physical battery characteristics, such as state-of-charge feasibility and efficiency losses. If operating the storage resource to only bid into the DA energy market, this is not an achievable outcome to compensate for the REAP value substracted from the strike price.

- Node vs. Zonal LBMPs – Nodes that have persistently lower/less volatile DA energy prices than the Zonal reference would be adversely affected.

- Asset Downtime – during outages, you would forgo market revenues and the ISC payment, making it extra costly to have downtime, even during periods of low energy prices/value.

- Capacity – The RCP component assumes that the storage resource will be able to consistently clear in NYISO’s capacity auctions. Likewise, if you enter into a bilateral/long term capacity contract where the capacity rate is below the monthly auction rate, you would be exposed to that difference in the ISC calculation.

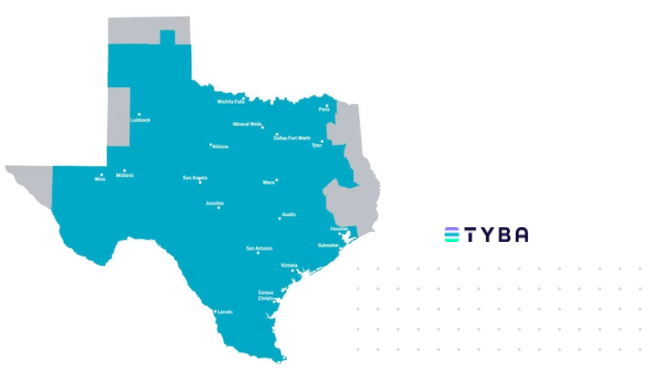

Work with Tyba to devise your development strategy

Tyba can support your modeling efforts to evaluate this proposed program including:

- Quantify historical ISC value with REAP and RCP values for every zone.

- Project REAP and RCP values based on forward curves.

- Identify the best locations by understanding how your project/node compares vs. its Zonal benchmark.

- Simulate how achievable various operating strategies are to inform your ISC bids.