Guides

Maximizing energy arbitrage with Dynamic Price-Quantity Bidding

Case Studies

Shoulder season is firmly upon us in ERCOT. And while most are fixating on the muted energy prices and diminishing revenue opportunity in Ancillary Services (AS), we are seeing real money making opportunities continue to surface.

For energy storage systems with tools able to navigate the ups and downs, that is.

So far this October, we’ve observed:

Successfully navigating this type of short-term volatility takes more than just strong forecasts, it takes agile bidding strategy that can selectively discharge energy into the most valuable subhourly intervals. Discharging too early or during the periods between price spikes can erode State of Charge (SOC) and reduce the ability to capture more lucrative peaks.

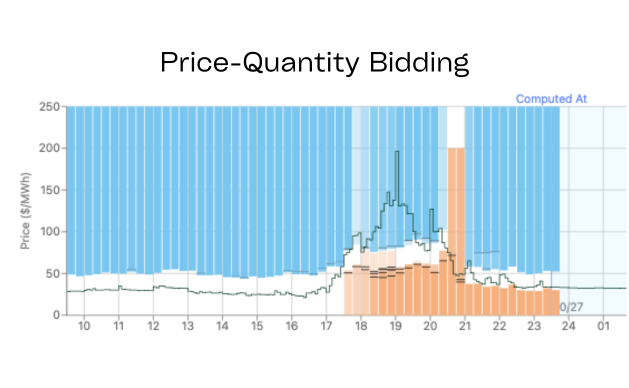

Take October 26th, for example. Prices cleared close to $200/MWh at 7pm, then close to $130/MWh at 8pm at HB West.

Tyba’s forecasting engine identified both the primary peak and the sustained price elevation. But this was only part of the puzzle. Our ability to discharge into those peaks – and not the comparatively low prices between them – was required to maximize revenue amidst the intra-hour volatility.

On this day, Tyba’s Dynamic Price-Quantity (PQ) Bidding was able to do this seamlessly. To optimize dispatch, we:

This pattern maximized spread capture and avoided inefficient mid-interval cycling, demonstrating how dynamic, interval-level optimization can materially improve performance.

Often, when we see multiple peaks that are fairly close together in this manner, it is well correlated with storage output. On 10/26, batteries in ERCOT began to ramp up their output around 5:30pm with discharge peaking at 8.3GW at 6:45pm. Much of this capacity was still discharging for the first peak (7.9GW at 7pm). However, capacity then began to dwindle and by 8pm, when the second peak hit, only ~4GW remained discharging.

Luckily, PQ bidding serves as a hedge here. When prices have these intermediary dips, smart PQ bids won’t clear and capacity will be reserved. That way, when prices go back up, these well managed assets will have energy left in the tank to discharge and capture the higher prints.