Expanding across ISOs is difficult. Different rules, products, cadences, constraints, and interfaces make it risky to “copy and paste” a playbook – or optimization tool – from one market to another. The fastest way to leak revenue is to treat CAISO and ERCOT like they work the same way – they don’t. This forces traders to juggle multiple mental models every day.

Tyba is built so you don’t have to worry about the cross-ISO complexity. Whether it’s meeting your asset’s Resource Adequacy (RA) obligations or integrating ERCOT’s new RTC+B model, Tyba streamlines operations and automates ISO-compliant bidding and continuous node-level optimization, turning those differences into revenue.

Below is a trader-first guide to what’s materially different in day-to-day operations.

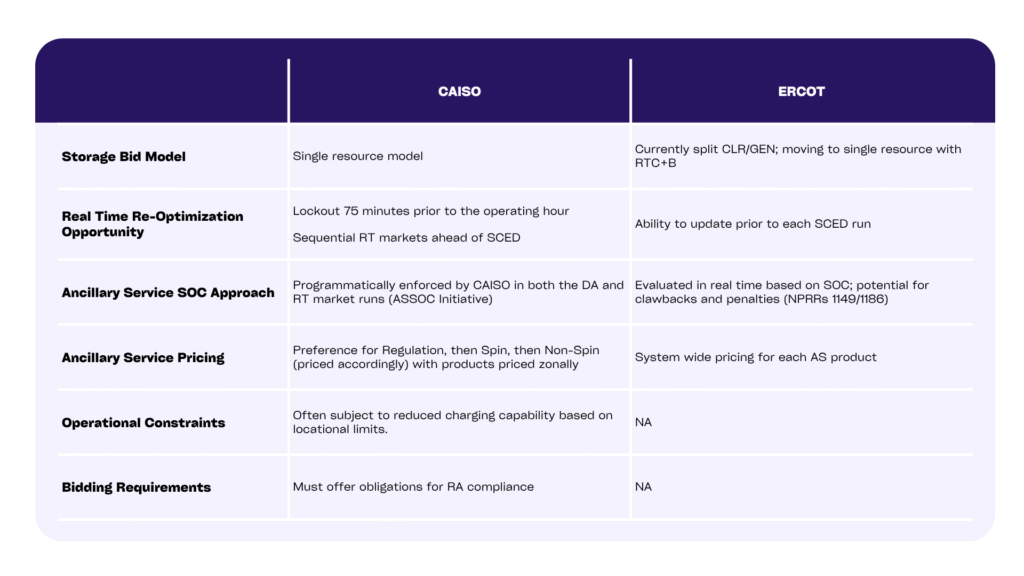

ERCOT vs. CAISO

While they are the two largest storage markets in the U.S., ERCOT and CAISO are not interchangeable. How storage is modeled, the timing of bids, and how Ancillary Services (AS) shape your state of charge all differ. You need strategies that speak both languages, and a platform tailored to the market nuance.

Storage Bidding Model

In ERCOT today, a battery is modeled as two resources, a Generation Resource for discharge and a Controllable Load Resource for charging, so you manage two offer curves and two sets of telemetry. On December 5th, this is changing to a single model as ERCOT is transitioning to a single model as part of RTC+B. Under the single model, you will submit one bid curve that spans charge and discharge with one set of telemetry and settlements, which reduces modeling friction and brings ERCOT closer to CAISO’s single-curve world.

In CAISO, a battery participates as a single resource under the Non-Generator Resource model. You submit one energy bid curve that covers both charging and discharging, so the market sees your full operating range and dispatches across it with a single view.

CAISO also has a bilateral capacity market where resources with RA contracts are subject to must-offer obligations, which lowers how much AS the ISO procures compared with ERCOT. That difference means ERCOT traders can often lean more on AS capacity payments, especially on low volatility days, while in CAISO, significantly less AS capacity will clear each day. Furthermore, with only one bid pair for each interval in CAISO and a lower amount of AS, you need more precise bids.

Real Time Re-Optimization Opportunity

In ERCOT, bids for the Real-Time (RT) Market can be edited 5 minutes prior to each Security Constrained Economic Dispatch (SCED). This flexibility enables operators and optimizers to adjust bids as the day unfolds with a tighter feedback loop.

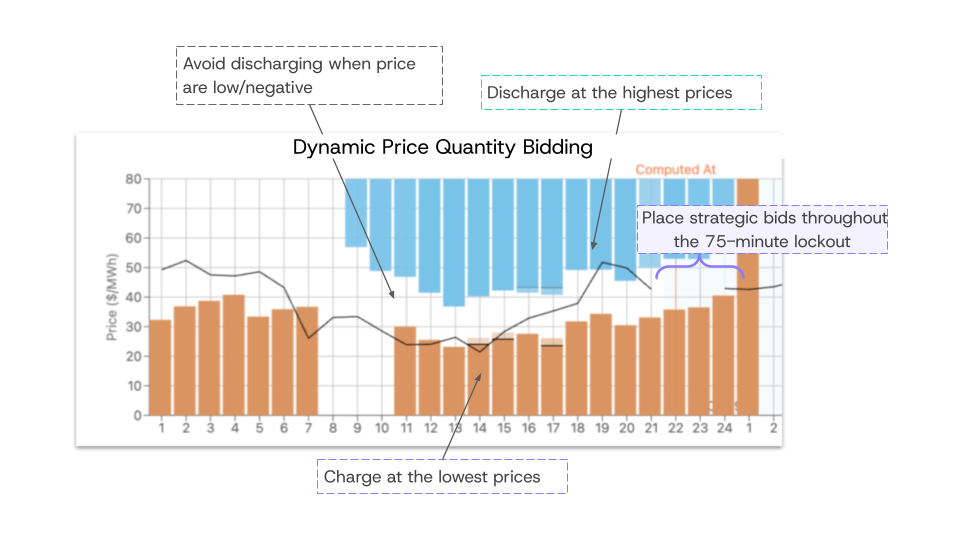

In CAISO, bids for the RTM are due 75 minutes before the start of the operating hour. CAISO then clears bids/offers for the following hour in 15-minute increments – this is called the Fifteen Minute Market (FMM). Once the operating hour begins, CAISO also runs a Real-Time Dispatch (RTD) where they adjust the amount procured in 5-minute intervals to address any imbalance. The 75-minute lockout period requires operators to bid early, hold up under changing conditions, and plan for more uncertainty.

Tyba has an edge in both markets because our price quantity (PQ) bidding sets exactly how much you will buy (orange in chart) or sell (blue in chart) at each price, so you get the amounts you want at the clearing price. From there, our optimizer stages the PQ curves ahead of time, keeps the right state of charge for any awards, and rolls the plan forward each interval so you stay compliant and still target the strongest prices while meeting RA obligations and navigating co-location constraints as applicable.

Ancillary Service State of Charge Approach

In ERCOT today, AS are awarded in the Day-Ahead Market (DAM), and you carry that responsibility through real time. If your obligation is called and you come up short, ERCOT levies a penalty that turns these misses into direct costs. On December 5th, this is changing under Real-Time Co-optimization plus Batteries (RTC+B), when ERCOT will co-optimize energy and AS in real time. From that point, DA AS awards become financial obligations, and operators can swing out of them in real time. There will still be duration requirements and potential for imbalance exposure, making SOC management equally important but functionally unique.

CAISO aims to procure all necessary AS capacity in the Integrated Forward Market (IFM), which is their equivalent to the DAM, but can also clear additional MWs in the FMM and RTD. In real-time, the ISO shapes dispatch to keep those awards deliverable, which can mean charging or holding back even when prices aren’t ideal. CAISO is protecting your ability to meet the award, but also acknowledges it can result in “uneconomic energy awards.”

CAISO-Only Considerations

CAISO also has nuances you won’t see in ERCOT, and they directly influence your bids and operating plan.

Ancillary Service Pricing

In CAISO, AS are Regulation Up and Down, Spinning Reserve, and Non-Spinning Reserve, and they are priced by zone rather than one uniform system price. The practical takeaway is to treat AS selection as a zonal decision. An advanced optimizer like Tyba learns your node’s historical signals and bid into the most lucrative product in that interval after accounting for energy opportunity cost and deliverability.

Operational Constraints

In CAISO, your ability to charge is a nodal question, not a blanket right. Local transmission limits and congestion around your node can cap how much you can draw, slow your ramp, or block charging in hours you planned to refill. When these limits bind, dispatch prioritizes feasibility and reliability over pure economics, so you might be held back from charging even when prices look attractive. Co-located and distribution-level rules can further restrict charging, for example, via the aggregate capability constraint at a shared interconnection or by electing to prevent grid charging at certain hours.

Bidding Requirements

In CAISO, over 60% of energy storage systems have Resource Adequacy (RA) obligations. An RA contract is a bilateral capacity deal between a Load-Serving Entity (LSE) and a resource that counts toward the LSE’s RA requirement. The contract specifies how much qualifying capacity the resource must make available and when, and it triggers a must-offer obligation to bid into CAISO during those hours. Under the Slice-of-Day framework, this is shaped by the hour. Many contracts may require all-hour must offer obligations, but some contracts might be more flexible – with “Flexible RA” – and only require bidding into certain time blocks that vary by season. Contracts can also include price guardrails or other bidding rules.

Failure to meet can have dire consequences for contracts – and therefore revenue. RA terms mandate that bids/offers must be submitted, but it does not specify the price at which you offer that energy so long as they adhere to CAISO market rules. The craft is choosing offer prices that keep you compliant while preserving higher-value hours elsewhere.

As an operator, executing on every RA term can be time-consuming and, let’s face it, not the best and highest use for your team of traders. That’s why it’s a non-negotiable that your optimizer encodes RA obligations down to the hour, product, quantity, and any price rules. Tyba does this by default (before you launch) and ingests day-by-day instructions so operators stay 100% compliant while still pursuing the best value.

How to Maximize Storage Revenue in Both ERCOT and CAISO

Running storage across ERCOT and CAISO without a system that scales – and without experts who’ve done it before – will leave money on the table. The rules, cadences, and obligations are different enough that copying and pasting a playbook doesn’t work.

Tyba’s Asset Operations Platform is built so you don’t have to carry that complexity in your head. The optimizer is programmed with the market details that matter – lockouts and five-minute rhythms, RA must-offers, SOC and duration needs, zonal pricing, and nodal constraints – so bids stay ISO-compliant and strategies keep chasing value as conditions change.

You still have the controls you want when you need them. And with Tyba you will have the capacity to leverage them to execute on your market perspective. You can adjust bid plans, set limits on specific products, and tailor risk parameters, while resting assured that you’ll remain compliant with all project constraints and market rules.

Most importantly, you’re not doing this alone. Our expert power-markets team has implemented these workflows across both ISOs and helps you ramp quickly, explain what’s changing, and pressure-test your strategy before you go live. Pairing automation with experts is how you avoid costly misses and turn market differences into revenue.