With over a week to digest the “One Big Beautiful Bill” (OBBB) and months of anticipation, our industry now needs to figure out how to move forward.

Between the tax credit cliffs and the unworkable FEOC constraints, CAPEX and the cost of capital will increase for critical new energy and capacity sources. In effect, this OBBB is shifting the cost burden for meeting our country’s energy needs from the federal government to consumers and developers. All while grids across the US are struggling to meet existing demand growth.

We know what this means: costs will go up, and reliability will suffer if we don’t act.

Evolving market design to promote increased supply and reliability

We’re facing a future where high costs and growing demand will affect not just power producers – but also businesses that need energy to innovate, and consumers that need energy to get through the day. Unless they want to face more (and more intense) blackouts and rate hikes, grid operators need to step up and make markets work better for flexible assets like energy storage.

Why batteries?

In a world where electrons are going to be increasingly scarce, storage is the only solution readily available to put each last electron to good use. They provide clean, dispatchable capacity as they respond to market signals within seconds, and improve the profitability of all generation assets – which is critical in this new environment where we are asking developers to shoulder more of the costs.

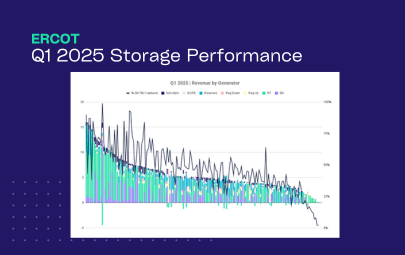

Fortunately, the blueprint for a dynamic market that recognizes and rewards asset flexibility and responsiveness has been proven out.

There are a couple key changes that other market operators can make to help increase efficiency, allow producers to make money when they invest in assets most beneficial to the grid, and lessen the burden that the OBBB will have on our rapidly growing industry. A few include:

- Make the market real-time: Allow assets to submit bids and offers every five minutes, allowing fast-responding resources to capitalize on volatility and unexpected scarcity.

- Implement scarcity pricing rules: When reserves are tight, prices spike — providing strong signals and rewards for assets that can show up.

- Introduce performance-based compensation: Revenues ought to be driven by actual market participation, not capacity payments, so grid contribution gets paid.

We are on the verge of a paradigm shift. Grid operators need to recognize the outsized value that storage provides, and take action. Despite the intense setbacks in this bill, we believe that storage equipped with the right software will become the most valuable asset for power producers, leading investment cases, portfolio expansion, and higher revenues.

What can developers and operators do in the interim?

Now, we are not ignorant to the fact that market reform can sometimes take longer than one might hope. The good news?

In a high-cost, high-demand energy industry, wholesale prices should be on the rise. This presents opportunities for producers that take full advantage by leveraging flexible assets like batteries.

Batteries can be quickly deployed to meet demand – and capture higher prices – when the grid needs it. But power producers need to get creative to get new projects in the ground, and bring on the right software tools to make the most of the assets that do get built.

For new storage projects, whether assets are standalone or paired with generation, getting to the right project design, and getting there quickly, is critical. Companies need to find a way to develop projects that pencil – and for renewable projects, in time to access 45Y or 48E production and investment tax credits. To do this, we must revisit long-held assumptions about what works. With less of the capital stack coming from tax equity, more scrutiny will be placed on revenue assumptions, offtake structures, project execution, and plant design.

Is your organization ready to come up with new approaches and partner with counterparties to make projects a reality? This will require accurate and efficient modeling, leveraging tools that account for site-specific market behavior, revenue streams, and project economics in minutes.

For those that already have energy storage systems online – now is the time to make the most of existing assets.

Battery operators have spent the last year figuring out how to scrape a slim edge amid lower prices and volatility (ironically proving just how valuable batteries are to consumers as these actions have improved reliability, met growing demand, and reduced prices). Soon, the challenge will become figuring out how to avoid being left behind as the top operators differentiate themselves. Volatility means opportunity for batteries, and with an aging thermal fleet, tighter reserve margins, and more extreme weather events, we should have no shortage of it.

Tyba’s real-time optimization platform helps operators maximize revenue potential by forecasting price movements, dynamically adjusting bids, and responding to market signals as they emerge. Getting this right will allow IPPs to compensate for the increased costs from new development. Is your organization prepared to consistently identify the best product to sell across a range of possible energy, Ancillary Services, and bilateral applications, without taking undue risk?

We know our solution helps, but it’s only one contribution amidst many that are needed to overcome the growing deficit in the energy industry. It’s going to take immense coordination and creativity to make the power sector work for consumers and developers. I look forward to working through these challenges with everybody still fighting for the modern grid we deserve.