Storage is fast becoming the most valuable resource on the grid. The asset class is uniquely able to deliver on the shared objectives of grid operators, energy producers, and consumers given their ability to provide:

- Clean firm supply to support rising, and increasingly variable, electricity demand

- Flexible capacity able to respond to both supply and demand fluctuations in a matter of seconds.

- Affordable power unlocked by project profitability to ensure owner/investor returns for continued investment.

That is, if it is operated effectively, and in a system designed to value and capitalize on its unique capabilities.

On the afternoon of July 9th, Tyba co-founder and CEO, Michael Baker, presented at FERC’s conference, “Increasing Real-Time and Day-Ahead Market and Planning Efficiency Through Improved Software,” on how software can unlock the dynamism required for batteries to maximize their impact to the grid, proving instantaneous, clean, and flexible power.

Batteries will enable the modern grid – if we let them.

Energy storage can help alleviate grid strain, and deliver clean, reliable power to the grid exactly when it is most needed. However, both optimization software and ISO market design that more intentionally incorporates and values storage are required to make this a reality.

| Objective | Battery capability | Software solution required | Market design required |

| Meet growing energy demand | Quick to deploy | Accelerate and optimize project design modeling | Streamline interconnection and resource participation |

| Flexible grid capacity | Reduce demand and/or increase supply | Software responsive to upcoming grid conditions | Ascribe value for full range of services provided |

| Ensure long-term reliability | Fast response in critical periods | Software able to forecast and deploy when the grid needs it most | Reward flexibility, availability, and fast response |

| Maximize grid infrastructure | Flexibility across location and scale | Software able to balance project and transmission constraints | Market signals that reflect local value |

| Maintain grid stability | Respond to grid signals in seconds | Automated bidding and real-time dispatch | Real-time market structures |

| Attract continued investment | Strong returns to project owners, operators, and investors | Maximize project revenue | Market frameworks that value flexible, responsive capacity |

The role of optimization software

Tyba’s optimization platform ensures a battery is always positioned for the most valuable opportunity — for the grid operator and owner.

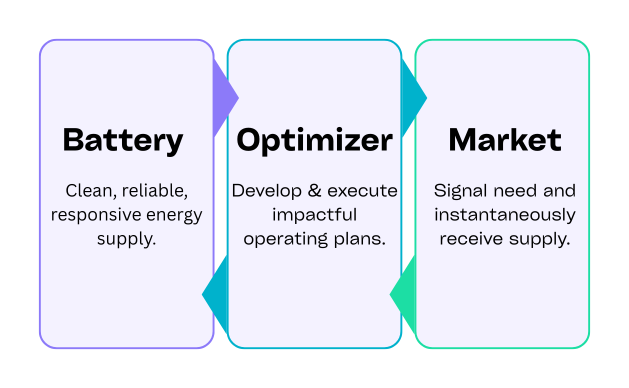

At a high level:

- We implement a Real-Time automated strategy with Day-Ahead and bilateral planning and customization.

- Informed by forecasts, inclusive of all grid data – and project + market constraints

- Continuous optimization lets us navigate amidst uncertainty

How it works:

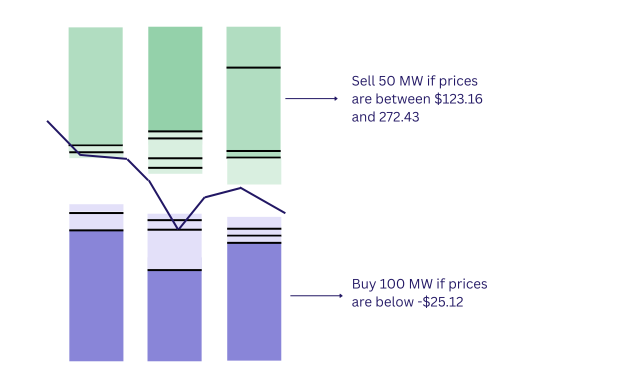

[1] Determining the optimal bid pairs

There is always a price at which we are willing to buy/sell energy. To do this, the algorithm continuously:

- Looks ahead at the next operating interval and calculates the exact prices where there is a shift in how much we are willing to buy/sell

- Evaluates PQ supply curve across all points to determine the optimal bid pairs (ie. sell 50MW if the prices are between $123.15-272.23)

- Specifies how much each MW is worth to us at each time by submitting to the grid operator

[2] Informing the operating plan

To be available in the most valuable moments, the optimizer needs to both intake information in real-time, and account for asset conditions and market rules.

- Price forecasts that detect volatility before it is reflected in system prices, or causes reliability issues or the grid

- State of Charge (SOC) management to ensure the asset can deliver energy during high-value intervals

- Hard-coded regulatory logic to remain compliant with market rules and constraints

Deep dive:

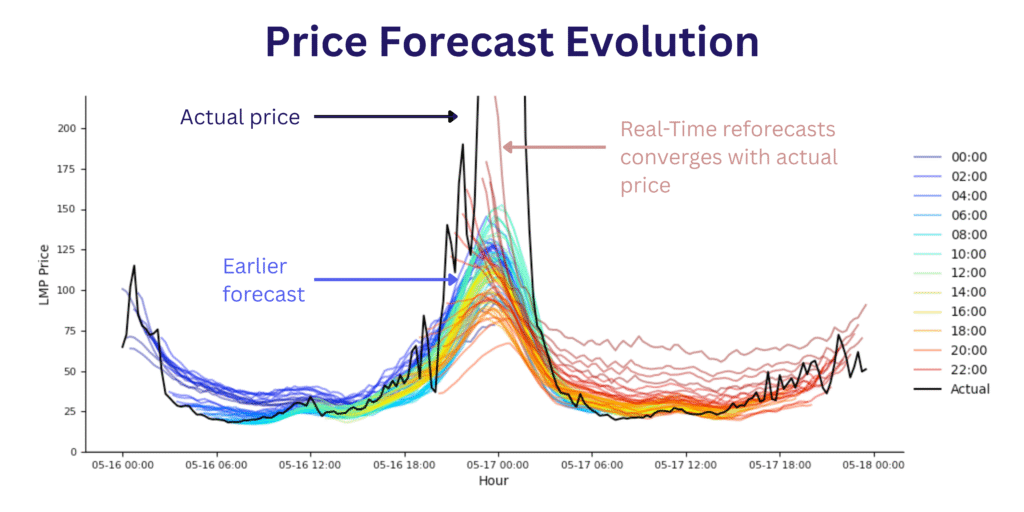

Getting highly attuned and accurate forecasts

Tyba’s AI-powered forecasting engine ingests a wide range of grid- and location-level data — including weather conditions, load forecasts, generation outages, and local supply-demand dynamics.

But more than just processing inputs, the system is trained to understand which changes actually matter for price formation. To teach the model these nuances, we step it through time — having it forecast with only the information that would have been available at each historical moment, then comparing its predictions to actual market outcomes. This approach allows the model to learn, for instance, that a minor temperature shift might not move the market — but a large drop in wind generation very likely will. The result is a forecasting engine able to map grid and market conditions to pricing consequences.

[3] Strategic Day-Ahead planning is required to enable RT success

You can’t show up in real-time if you weren’t positioned in advance. Strategic Day-Ahead planning is how the system ensures:

- Duration requirements are met

- SoC is preserved for future intervals

- Bid commitments don’t interfere with real-time flexibility

The optimizer solves forward based on a range of possible outcomes — planning for uncertainty, not assuming it away.

Let software and storage build the grid we need

Energy storage can deliver the clean, responsive, reliable power the modern grid demands. But it can only do that if:

- Software is in place to optimize under uncertainty, and

- Markets are structured to fully unlock and value the services batteries can provide

The fastest, cleanest, and most flexible asset class on the grid deserves a market that’s just as nimble.