Case Studies

ERCOT’s first major price spike of the season – breaking down May 16th

Low wind output, high net load, and a market notice limiting outage timing led to interesting price formation in ERCOT.

On the evening of Friday, May 16th, the majority of ERCOT experienced the first Real-Time (RT) energy price spike of the season. In addition to rising temperatures, the spike was driven by:

- Low wind production relative to forecasts

- Continued thermal outages

- Solar ramping down

- In the interval prior to the peak, there was ~4GW of RT remaining capacity with an energy offer in SCED (e.g. very low reserves)

Across all zones, prices were elevated (clearing in the hundreds of dollars range) for over 2-hours, and stayed extremely high (thousands of dollars) for close to 60 minutes.

Timeline of the Real-Time energy price spike:

- 6:30pm – Prices began to rise

- 7pm – RT energy prices crossed $1K/MWh mark

- 7:45pm – Prices peaked just under $4K/MWh

- 8:10pm – Prices were petering off (though still clearing ~$300/MWh)

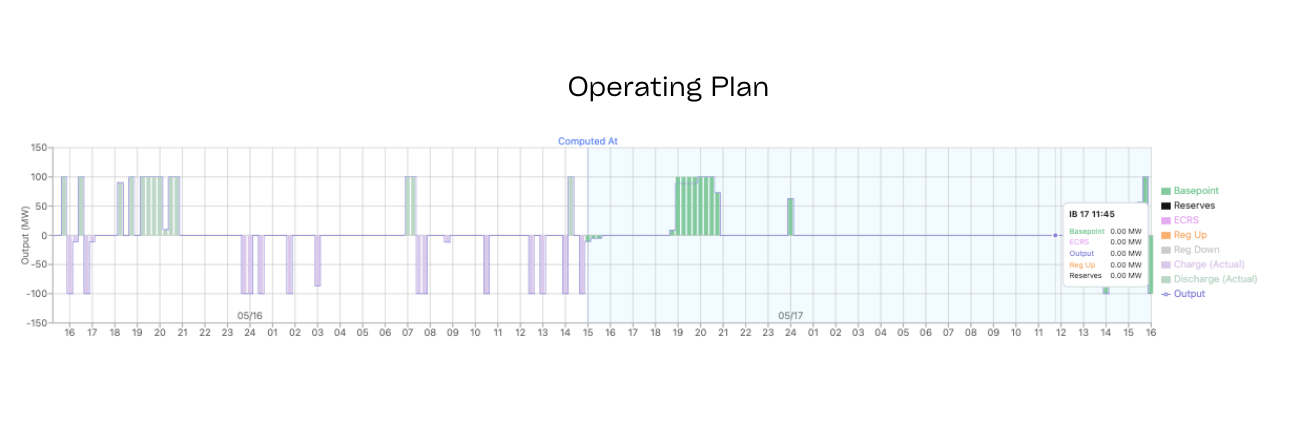

Operating strategy deep dive

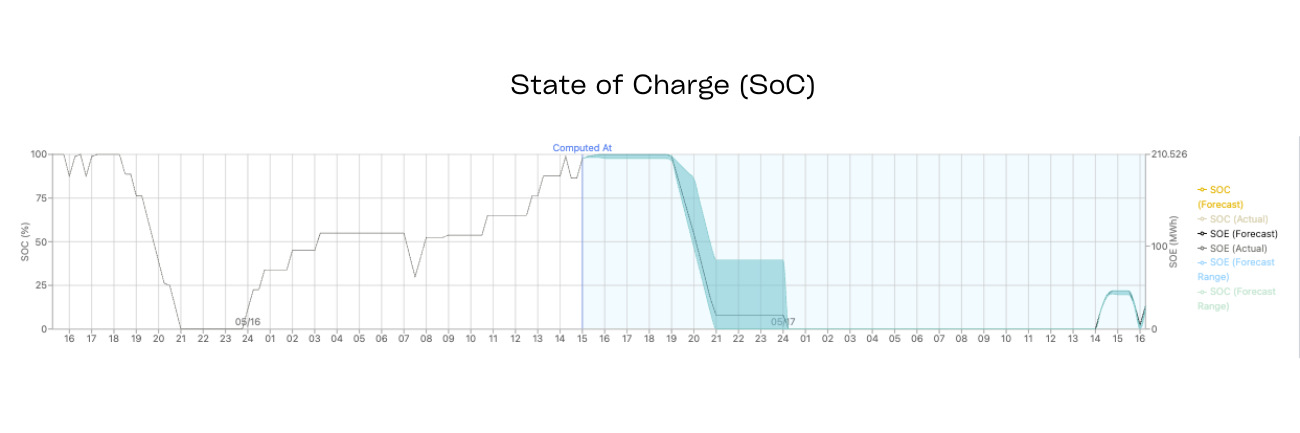

Let’s take a look at how May 16th played out for a sample asset in ERCOT’s West Load Zone. This is a 100MW / 2 hour standalone energy storage system.

- Prior to the Day Ahead Market (DAM) close for May 16th, Tyba’s pre-DA close forecast picked up on RT energy price spike potential during IE19-21

- By the afternoon on 5/16, rolling RT energy re-forecasts picked up on increased magnitude and likelihood of a spike

To prepare for these high prices, the optimizer guided that energy storage system to charge in the early afternoon, while prices were low, to maximize the asset’s ability to discharge from IE19-21.

Interestingly, during the peak (7:45pm), only ~2.5GW – or about 22% of ERCOT’s storage fleet – was discharging. Around 8.6GW of resources were committed to an up Ancillary Service (AS) product during the 7pm hour. Assuming a large portion of this was from storage assets, the overcommitment to AS likely led to much of the storage fleet missing out on the RT energy upside.