Case Studies

Guides

Everything you need to about MA DOER’s energy storage RFP.

On May 5th, the Massachusetts Department of Energy (DOER), in collaboration with the state’s electric distribution companies (i.e. utilities), announced the launch date for the first in a series of long-anticipated solicitations for grid-scale energy storage. The RFP will open on July 31, 2025, and marks the first of at least four rounds aimed at procuring 5GW of storage capacity before July 31, 2030.

This represents a great opportunity for energy storage developers and operators to secure a long-term revenue stream through the state’s Clean Peak Standard (CPS) and deliver clean, reliable energy to the MA grid.

“DOER, in consultation with the Independent Evaluator, must select Long-Term Contracts that are cost-effective mechanisms for facilitating the financing of beneficial, reliable energy storage systems on a long-term basis for the benefit of ratepayers.”

The RFP seeks “beneficial, reliable Energy Storage Systems” that support long-term grid reliability from clean, reliable BESS. Winning projects will enter long-term contracts (up to 30 years) with the state’s utilities, with pricing structured on an annual, fixed $/CPEC basis that the owner bids in during the RFP. Notably, the battery owner will maintain operational control.

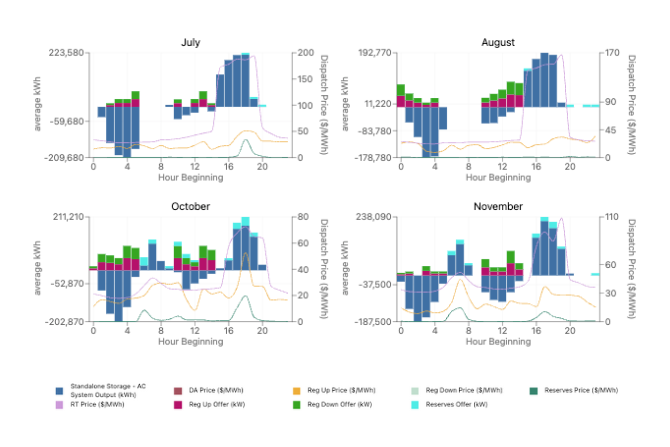

The Massachusetts Clean Peak Energy Standard (CPS) is a market mechanism designed to incentivize clean energy resources by awarding Clean Peak Energy Certificates (CPECs) to eligible resources that supply electricity or reduce demand during peak hours.

The program was designed such that multipliers are applied to the MWhs discharged into peak demand periods where the MA grid has typically relied on more carbon intensive generation resources.

These CPECs are sold to electricity providers, which are required to buy a certain number of CPECs annually.

We have a deeper dive on CPS here >>

With so much riding on thoughtful project design and a competitive bid, Tyba’s Project Simulation product can help developers hone in on the optimal project design and CPEC bid price.

You can:

With this, you’ll be able to compare how various project options will operate and the achievable financial outcomes of each.

By effectively operating the asset – maximizing CPEC value and layering on wholesale market revenue – CPS can account for up to 70% of revenue over a 20-year term.

In this example, which assumes a project can be live by 2027 to leverage the NTRM, we find CPS revenue can range from $12-24/kW-month, and accounts for 53-70% of revenue share over 20 years.

The RFP will be evaluated in three phases:

The process will kick off this summer, and aims to have the selection process wrapped up before the end of the year.