Guides

A Trader’s Guide to Controlling Storage Optimization Strategy

Action on your market expertise with in-platform controls for your energy storage operating strategy.

With how quickly energy markets move – and how complex and unique each one is – optimization software is essential. But it shouldn’t come at the expense of control.

Expert trading teams need tools that allow them to influence strategy, and implement their unique market perspectives. The best optimization platforms make that simple. Whether you want to adjust high-level optimization parameters or edit individual bids, the right controls should make it easy for you to remain in the pilot’s seat – should you choose to.

At Tyba, we built our platform to be the “autopilot” for batteries. It can run automatically – placing bids, reading awards, executing day-to-day operations. And you can take the reins at any time.

Below is a simple example of the types of adjustments an operator might make based on daily conditions, for teams that do want to be more hands on.

Day-in-the-life

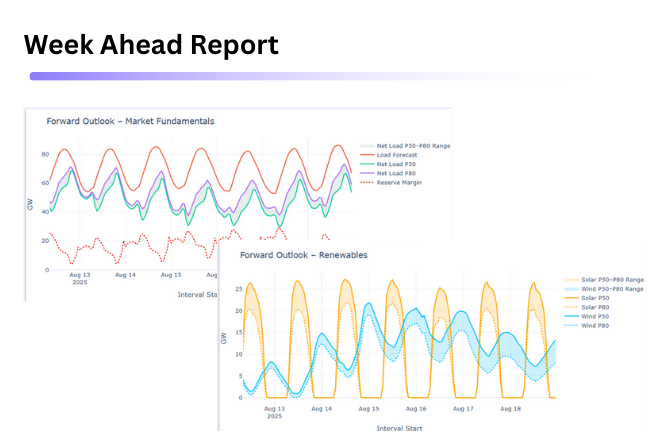

[1] Week ahead market dynamics

In preparation for the week ahead, you review the market fundamentals to get a sense for which days, if any, have the potential for interesting price activity. Say, hypothetically, you see that Wednesday is forecasted to have high load, and is relying heavily on wind production to meet demand. You know that in ERCOT, for example, wind underproduction post solar ramp down can be a key driver of Real-Time (RT) energy price spikes.

With this intel, you decide to reserve the majority of your battery’s capacity for RT energy participation during the evening net load peak that Wednesday.

[2] Strategy adjustments

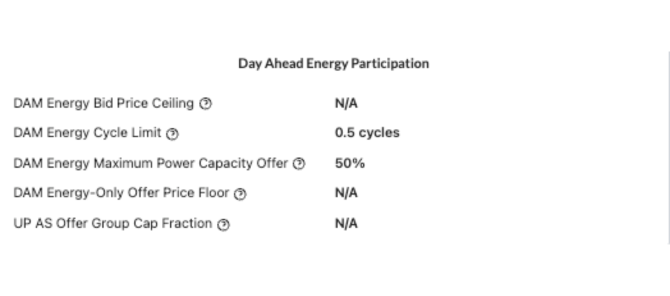

To ensure your battery is poised to capture RT opportunities, you may want to make a few strategy adjustments before the Day-Ahead Market close to ensure your asset is charged and available for RT energy participation during the evening peak.

Inside Tyba’s web app you could take the following actions to influence Wednesday’s operating plan:

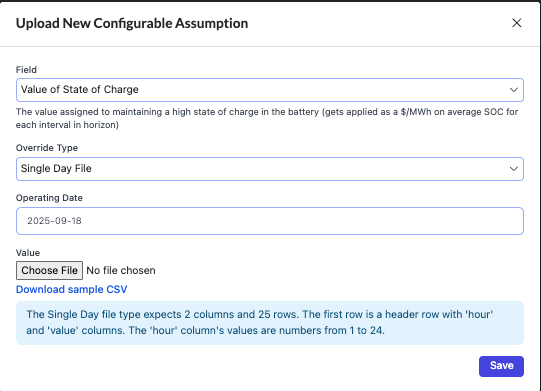

- Increase the Value of State of Charge (VSOC): This tells the optimizer to maintain a higher SOC, even if it means paying a couple dollars more to charge. The payoff? Your asset will have energy in the tank to capture short, high-value RT energy spikes.

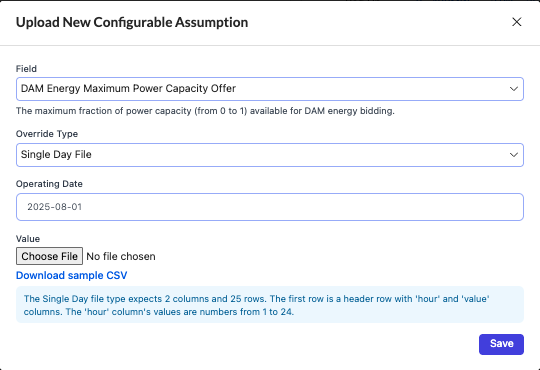

- Limit Day-Ahead Energy Capacity to 50%: This ensures the optimizer never bids more than half of your capacity into DA energy, so at least half of your capacity is reserved for RT dispatch.

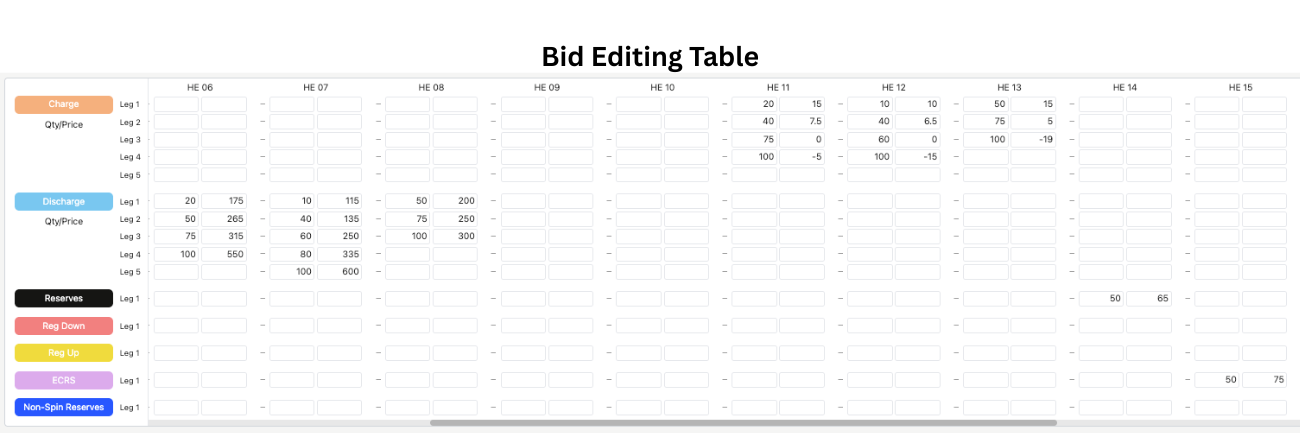

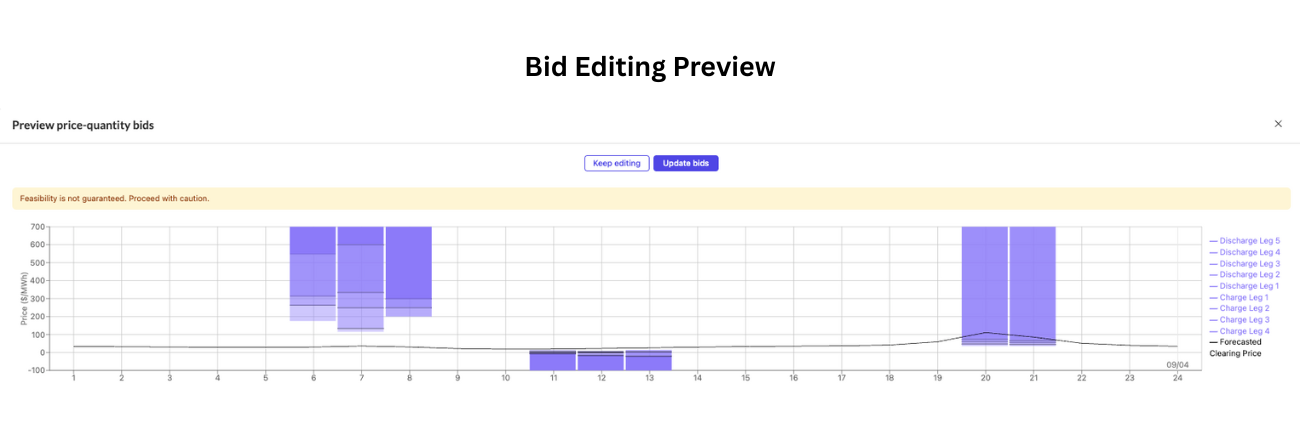

[3] Refine Day-Ahead Bids

Next, you review your Day-Ahead bid plan. Price forecasts are showing the highest price potential in hours 20 and 21. To capture that upside, you increase the offer prices for a few DA bid legs to reflect the opportunity cost for allocating into DA versus saving for RT.

By raising those offers, you ensure that the capacity you clear is aligned with actual market value. If DA prices clear high, you’re happy to commit a bit more capacity. If they don’t, that’s fine, you’re positioning for elevated RT prices instead, and low DA offers aren’t worth the risk today.