Industry Insights

2026 Energy Storage Predictions

Energy storage is poised to unlock more creative trading and hedging strategies, make flexible load viable, and see increased investment.

As the energy industry heads into 2026, contradictions are driving conversation. Revenues are under pressure in mature markets, even as investment continues at scale. Load growth is accelerating, yet the infrastructure required to support it is slow to materialize.

Luckily, energy storage is stepping in to help.

Below are three predictions we believe will define the next phase of energy storage and power markets in 2026, spanning how assets are traded, how large loads are integrated, and why long-term confidence in storage remains strong.

[1] Storage and the financial services surrounding it have matured – and will enable more sophisticated portfolio-level trading and hedging strategies

Storage has become a critical part of nearly every energy portfolio. All market participants – Independent Power Producers (IPPS), utilities, large loads, traders, etc. are adding batteries given the value that their flexible capacity provides.

As storage penetration has increased, so has the maturity of those who own and operate the assets – as well as the financial ecosystem around it. In 2026, we expect this to show up in several ways, including:

- Advanced portfolio-level trading strategies: optimizing across the full portfolio rather than individual assets to allow for more intentional risk taking

- Hedging and risk management: covering a short, real-time position taken by a generation asset or financial instruments (e.g. Futures or TB swap positions)

- More diverse long-term offtake structures: greater adoption of tolls, TB swaps, and revenue floors as more participants enter the space

In the most mature energy markets (e.g. ERCOT), traders are already getting more creative in their approaches – arbitraging DART spreads, balancing Ancillary Service (AS) and energy offers in each interval, and leveraging storage to backstop more aggressive generation and financial positions.

As we move into 2026, these dynamics will become more prevalent, with batteries playing an increasingly active role in short-term risk management. Market participants will use storage to support financial positions taken through ICE, long-term offtake agreements, and even emerging platforms like ElectronX. In this context, batteries serve as a physical hedge – allowing companies to take on more risk while retaining the ability to manage short positions in real time.

This shift materially changes risk management approaches. When storage can reliably cover situations in which a company is short in the real-time market, traders and portfolio managers gain more flexibility in structuring both financial and physical positions. The result is a broader set of viable strategies, greater willingness to engage across markets, and a more integrated view of storage as both a revenue-generating asset and a risk management tool.

In 2026, we expect this trend to accelerate. As storage continues to scale and financial products evolve alongside it, batteries will be increasingly valued not just for how they perform in isolation, but for how effectively they enable more sophisticated trading, hedging, and portfolio strategies across the power market.

[2] Batteries will make flexible load viable

It is no secret – data center developments are booming. Owners want to get their projects built and connected to the grid ASAP. At the same time, the US power grid does not have the infrastructure to support their voracious electricity demand. Many posit that “flexible load” (previously called Demand Response) will be the solution here, expecting the data centers to curtail their operations when grid conditions get tight. But, as it stands today, the incentives just aren’t there to compel data centers to participate.

For data center owners, compute time is the product. Downtime, throttling, or delayed workloads directly translate to lost revenue, breached SLAs, or degraded customer experience. Today’s market structures offer neither sufficient upside nor meaningful penalties to justify voluntarily giving up compute power – even when the grid is stressed.

However, co-located microgrid solutions that include cost-effective resources such as PV generation and flexible assets such as battery energy storage systems (BESS) provide a mutually beneficial solution.

Co-locating batteries with data centers provides the benefits to:

- Data center operators benefit from faster interconnection, and the incremental capacity to help serve their load profile, balance intermittent renewable generation, and potentially even generate incremental revenue from wholesale market participation.

- Grid operators get incremental capacity and the ability to call on those very same batteries during peak load periods to discharge and reduce grid strain.

In this model, storage absorbs the flexibility requirement. The grid gets responsiveness. The data center gets reliability and economic upside. And critically, owners avoid the lost revenue associated with true load curtailment. This could shift the conversation – enabling AI compute to grow and stay competitive, and provide day-to-day grid reliability for consumers.

[3] Storage revenues may stay compressed in the short-term – but investment will continue to chase the bright future

Over the past year, many have been dismayed by the lower revenue available for storage assets in ERCOT and CAISO. This compression is a direct result of more renewables and energy storage resources on the grid – helping to serve demand, balance generation, and reduce scarcity events. In many ways, this outcome is a sign of success. Storage is doing exactly what it was designed to do.

This dynamic is largely confined to the most mature markets, though. In other U.S. regions where storage penetration remains limited or nonexistent – prices have not smoothed in the same way, and reliability is a looming concern. Take PJM for example. For consecutive years we have seen capacity auction prices break records – with the latest prices clearing at the price cap of $329/MW-day, up 22% from a year ago for most of the ISO. This is a clear signal of tight conditions to come – and revenue opportunities for resources able to serve.

The potential for storage in these less mature markets is one of the reasons why investment in this critical resource is likely to remain strong in 2026.

The other, which will apply across all markets, is the increasing demand for electricity, which is expected to grow 25% by 2030 and 78% by 2050. We will see a tremendous amount of compute demand (+156GW of global AI-related data center capacity demand by 2030) on top of the demand from electrification. This will inevitably lead to grid strain, volatility, and increasing market prices. However, the growth in demand is not linear and will take time, given interconnection queues, supply chain delays, and permitting/build-out timelines.

What does that all mean? Revenue for storage operators is poised to increase in the fullness of time. But it may not be realized as soon as the next few months.

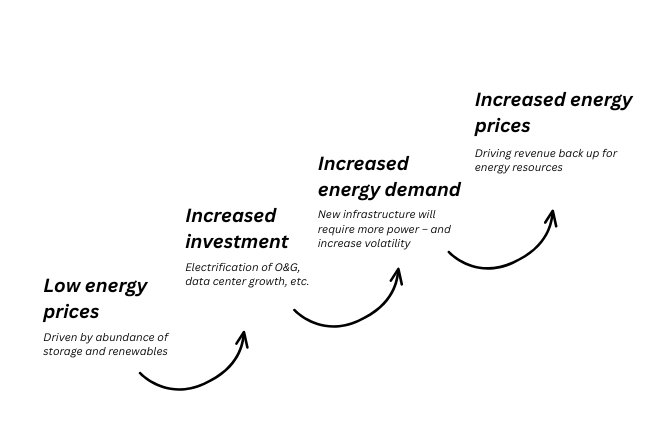

Take ERCOT for example. 2025 saw low storage revenue due to low energy prices and volatility. It is these low prices, along with a few other factors such as abundant land, favorable interconnection rights, and friendly permitting, that are attracting economic development. We see data centers flocking to the state, along with the electrification of key industries, such as the oil and gas sector.

Inevitably, these developments will increase energy demand and cause prices to rise again.

In many ways, battery investment today looks similar to equity markets during periods of economic stress – prices reflect expectations of future earnings rather than current conditions. Matt Levine described this phenomenon during the early days of the Covid pandemic. Stock prices were up despite corporate earnings being down. The market values not just present value, but expected future earnings. In the same vein, storage is being built not just for what markets look like today, but for what they are expected to become. Investors understand that sustained load growth, combined with intermittent generation, will eventually drive higher volatility and greater demand for flexibility.

The real question isn’t if that value shows up, but when.

In 2026, we expect this paradox to persist: continued pressure on short-term storage revenues in mature markets, paired with sustained investment driven by confidence in long-term fundamentals. The winners in this environment won’t be those waiting for conditions to improve – but those building the operational sophistication needed to perform through the cycle and be positioned when the market finally tightens.