Market Intel

Maximize the Profitability of Energy Storage Projects

Mission control for your growing storage portfolio with an all-in-one bidding, dispatch, and optimization platform.

Selected Clients

Trusted by companies leading the clean energy transition

Our results

Grid decarbonization

meets profitability

-

2GWh+

Assets under management

Operating supported across markets

-

50%

Revenue uplift

Compared to manual trading strategies

-

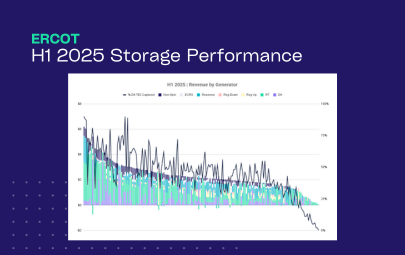

Top5%

Revenue performance

Revenue performance above 95% of ERCOT assets

Shared success

From designing your first project,

to operating a global portfolio

-

Prioritize high impact energy projects

Model thousands of project configurations to discover the optimal design.

-

Hone your bidding approach

Leverage market-leading forecasts to develop your bidding strategy and risk tolerance.

-

Operate live

assetsDevelop and deploy optimal dispatch strategies, bolstered by real-time optimization.

-

Grow your

portfolioPrepare for long-term growth & optimize across many assets and markets.

Platform overview

Developers, owners, and operators use Tyba for end-to-end project optimization

-

01

Understand future project returns

Transparent, configurable project simulations provide a realistic view of production and commercial outcomes.

-

02

Improve revenue outcomes with accurate forecasts

AI-powered price forecasts (complete with confidence intervals) for every product in the day-ahead and real-time markets to inform optimal bidding and dispatch.

-

03

Automate operations and maintain control

Tyba can serve as your auto-pilot, or your control center. Either way we’ll enable your team to unlock revenue uplift and streamline operations.

-

04

Maximize operating revenue

Bespoke daily bidding strategies that balance ancillary services with energy arbitrage yield revenue 3x higher than market benchmarks, without taking undue risk.